Read this article in Français Deutsch Italiano Português Español

Oil and gas sector activity remains weak in Dallas Fed survey

September 29, 2025

Executives report rising costs, flat production, and increased uncertainty

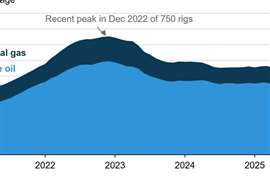

Activity in the oil and gas sector declined slightly in the third quarter of 2025, according to executives responding to the Federal Reserve Bank of Dallas’ Energy Survey. The survey’s broadest measure of business conditions, the business activity index, remained negative but edged up from -8.1 in the second quarter to -6.5 in the third.

The outlook index, which captures expectations for the future, fell sharply from -6.4 to -17.6, suggesting mounting pessimism. Meanwhile, the outlook uncertainty index stayed elevated, though it eased slightly from 47.1 to 44.6.

Production still soft

Oil and gas production was essentially flat, with both measures holding in negative territory. The oil production index registered -8.6, little changed from the previous quarter, while the natural gas production index was nearly steady at -3.2.

Costs climb higher

Rising costs continued to weigh on companies, particularly exploration and production (E&P) firms. The finding and development costs index rose from 11.4 to 22.0, and lease operating expenses climbed from 28.1 to 36.9. Among oilfield services firms, input costs rose but at a slower pace, with the input cost index easing from 40.0 to 34.8.

Services sector sees deterioration

Oilfield services companies reported modest deterioration across most measures. The equipment utilization index fell from -4.6 to -13.0, and prices received for services dropped further from -17.7 to -26.1. Operating margins remained deeply negative at -31.8.

Labor demand little changed

Employment and hours worked were relatively flat, though the aggregate employment index improved from -6.6 to -1.5. The aggregate hours index held at -3.7, while wages and benefits were steady at 11.5.

Price expectations mixed

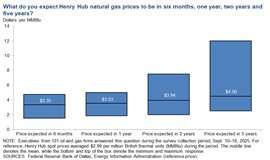

On average, respondents expect West Texas Intermediate (WTI) crude to finish 2025 at $63 per barrel, with forecasts ranging between $50 and $80. Longer-term expectations were $69 per barrel in two years and $77 in five years. For natural gas, executives project Henry Hub prices at $3.30 per million British thermal units (MMBtu) by year-end, rising to $3.94 in two years and $4.50 in five years.

During the survey period, WTI spot prices averaged $63.80 per barrel and Henry Hub averaged $2.99 per MMBtu.

Executives weigh in on policy, shale potential, and AI

Special survey questions revealed additional insights from industry leaders:

- Shale oil abroad: 77% of executives expect shale oil drilling to become commercially viable outside the U.S., Canada, and Argentina within the next 10 years.

- Regulatory changes: 57% estimate federal policy shifts since January 2025 lowered break-even costs for new wells by less than $1 per barrel, while 25% estimate reductions of $1–$1.99.

- Federal leasing: The majority of executives foresee only slight increases in crude and gas production from federal lands under the One Big Beautiful Bill Act, which lowered royalty rates and expanded leasing. Smaller E&P firms were more likely than larger peers to anticipate increases.

- Artificial intelligence: 49% of oilfield services executives expect AI to slightly extend the lifespan of equipment, while 12% expect meaningful gains. The remaining 39% see no benefit.

- China sourcing: Nearly half (49%) said up to one-quarter of their oilfield equipment comes directly or indirectly from China. Another 22% estimated 26–50% of equipment was China-sourced. Only 2% placed that share at more than 50%, while 27% reported no exposure.

- Supplier shifts: Among those with China-linked supply chains, 79% expect only a slight cost impact if sourcing moved to other countries.

Survey details The Dallas Fed collected responses from 139 energy firms between Sept. 10–18. Of the total, 93 were E&P firms and 46 were oilfield services companies. The survey covers firms headquartered or active in Texas, northern Louisiana, and southern New Mexico.

The next release of the Dallas Fed Energy Survey is scheduled for Dec. 17, 2025.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM