Read this article in Français Deutsch Italiano Português Español

Dallas Fed: Oil and gas activity slips in Q2 as production, employment and margins weaken

July 02, 2025

Tariff hikes, price pressures and produced water concerns weigh on industry outlook

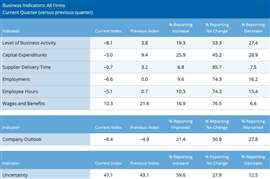

The U.S. oil and gas sector contracted modestly in the second quarter of 2025, with drilling activity, production, and employment all declining amid growing uncertainty, according to the latest Dallas Fed Energy Survey. The quarterly report, which reflects responses from 136 energy firms operating in Texas, northern Louisiana, and southern New Mexico, shows a broad pullback across exploration and production (E&P) and oilfield services companies.

The business activity index—the survey’s key barometer of industry health—dropped to -8.1, down from 3.8 in the first quarter. The negative reading indicates more firms reported a decline in activity than an increase.

“Sentiment has clearly turned cautious,” said the Dallas Fed in its July 2 report. The company outlook index remained in negative territory at -6.4, while the outlook uncertainty index climbed to 47.1, its highest level in a year.

Production edges down across oil and gas

For the first time in over a year, oil and gas production registered declines. The oil production index fell to -8.9 from 5.6, and the natural gas production index dropped to -4.5, signaling modest output reductions.

Drillers are responding to weaker pricing signals and rising cost pressures. When asked about year-end expectations, survey participants predicted West Texas Intermediate (WTI) crude will average $68 per barrel, with long-term expectations climbing only modestly to $72 in two years and $77 in five. Meanwhile, the average Henry Hub natural gas price forecast for year-end 2025 was $3.66 per MMBtu, with a five-year outlook of $4.50.

Survey responses were collected June 18–26, a period when WTI spot prices averaged $69.81 and Henry Hub prices averaged $3.30.

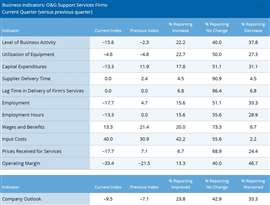

Oilfield services under pressure

The oilfield services sector showed signs of deeper stress. The equipment utilization index remained slightly negative at -4.6, while the operating margin index deteriorated sharply from -21.5 to -33.4, indicating steeper losses. The prices received for services index flipped from positive 7.1 in Q1 to -17.7 in Q2, a signal that pricing power has eroded.

At the same time, service firms reported rising costs. The input cost index jumped from 30.9 to 40.0, suggesting that inflationary pressures on labor, steel, and equipment continue to mount.

Among E&P firms, the finding and development costs index fell to 11.4, and the lease operating expenses index dropped to 28.1, indicating that while costs are still rising, the pace has slowed compared to Q1.

Employment demand softens

Headcount and hours worked also declined in the second quarter. The aggregate employment index fell to -6.6 from flat in Q1, and the employee hours index dropped to -5.1. Despite this, wage growth continued, though at a slower pace—the wages and benefits index slipped to 10.3, down from 21.6.

Tariffs dampen drilling expectations

A sharp increase in U.S. steel tariffs—from 25% to 50%—is beginning to ripple through the industry. When asked about the impact on drilling plans, 32% of E&P executives said they expect to drill fewer wells in the second half of 2025, while 22% said it was too soon to tell. Larger producers were less concerned than smaller independents, with 50% of large E&Ps reporting “no impact” compared to 44% of small E&Ps.

Tariff-driven cost increases were more acutely felt by small producers. Among all E&Ps, 26% said their well costs rose between 4.01% and 6% due to tariffs, and 21% reported increases of 6% or more.

Respondents were also asked how different oil price scenarios would impact operations. If WTI holds at $60 per barrel, 61% of E&P executives expect their firm’s oil production to decline slightly by mid-2026. Only 6% anticipate any production increase.

In a $50 oil price environment, 88% of firms forecast production declines, with nearly half expecting significant cuts. Smaller producers were especially vulnerable, with 48% saying they would reduce production substantially at $50 crude.

Oilfield services executives said falling oil prices would directly affect their pricing. At $60 WTI, 57% expect their firms’ primary service prices to fall slightly by mid-2026. At $50 WTI, 58% expect significant price drops, compounding pressure on margins.

Produced water management emerging as a constraint

One of the clearest emerging themes from the survey was concern over produced water management, particularly in the Permian Basin. Seventy-four percent of respondents said water issues will constrain drilling and completion activity over the next five years, with 32% expecting a significant constraint.

Several executives pointed to rising costs and regulatory uncertainty surrounding water injection and disposal, particularly in East Texas and West Texas. One respondent from East Texas warned of serious integrity risks from over-pressurized shallow injection zones and corrosion-related well failures, noting that “produced water is not only very high in salt content but is exposed to oxygen… [which] causes corrosion to any wells previously drilled.”

Another respondent cautioned that similar issues are affecting older plugged wells in the Permian, adding, “This is not just a Permian issue, but a national issue that is being used by certain parties to undermine aspects of the industry.”

Market faces continued headwinds

The Q2 survey results suggest that even with oil prices near $70, uncertainty, inflation, tariffs, and water management challenges are combining to suppress new investment. Comments from oilfield service providers highlighted oversupply in equipment markets and a “tough marketplace” with reduced contractor rates and delayed project timelines.

One executive summed up the mood: “The numerous negative tailwinds—tariffs, oversupply of oil, consolidation, and turmoil surrounding economic policy—will have significant impact on the domestic energy sector. A lengthy downturn is the logical outcome.”

The Dallas Fed’s next Energy Survey will be released September 24, 2025.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM