Read this article in Français Deutsch Italiano Português Español

Lower 48 rig counts fall, but U.S. oil and gas output continues to set records

November 17, 2025

Permian Basin count down 29% since 2022

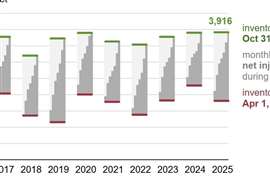

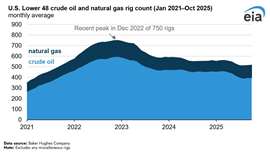

The U.S. Lower 48 rig fleet has contracted steadily over the past two years, even as crude oil and natural gas production continue to climb to new highs. According to the U.S. Energy Information Administration (EIA), the average number of active rigs drilling for oil and gas fell from a recent peak of 750 in December 2022 to 517 this October, reflecting weakened commodity prices and further gains in drilling efficiency.

Oil-directed rigs dropped 33 percent over that period, declining to 397 in October. Gas-directed rigs fell 23 percent to 120, after dropping as low as 96 rigs in September last year during a prolonged downturn in natural gas prices. Rig activity appeared to stabilize in October 2025, but remains well below pre-2023 levels.

Despite the slowdown, operators are delivering more hydrocarbons with fewer rigs. In July 2025, Lower 48 crude oil production reached a record 11.4 million barrels per day. Natural gas output followed suit in August, setting a new monthly high of 117.2 billion cubic feet per day. The EIA attributes the divergence between rig counts and production to operators’ continued focus on the most productive acreage, along with longer laterals, optimized drilling plans and more efficient completion techniques.

The Permian Basin continues to anchor U.S. supply growth. While the region’s rig count has fallen 29 percent since late 2022, oil production has risen 18 percent, or roughly 1 million barrels per day, over the same period. Productivity gains in the Permian have helped offset declines in other basins, reinforcing its role as the country’s primary growth engine.

Looking ahead, the EIA’s November Short-Term Energy Outlook projects a modest contraction in Lower 48 crude oil production in 2026, forecasting a decline of 0.1 million barrels per day, or about 1 percent. Natural gas production, however, is expected to increase slightly by 0.4 Bcf/d, or less than 1 percent.

Price expectations will shape activity. The EIA forecasts West Texas Intermediate crude to average $51 per barrel in 2026, about 21 percent below the 2025 average. Lower oil prices are expected to limit oil-directed drilling next year. In contrast, the Henry Hub natural gas benchmark is projected to rise to $4.02 per million British thermal units in 2026, roughly 16 percent higher than this year’s average.

With that shift, the EIA expects incremental growth from gas-directed drilling to outweigh declines in associated gas production from oil wells, supporting continued record-level output even as operators drill fewer wells overall.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM