Read this article in Français Deutsch Italiano Português Español

U.S. heads into winter with near-record gas in storage

November 14, 2025

Strong refill season, record production leave inventories above five-year average

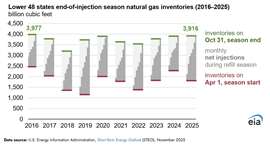

Working natural gas in storage across the Lower 48 states entered the 2025–26 heating season at one of the highest levels in nearly a decade, according to the U.S. Energy Information Administration’s (EIA) November Short-Term Energy Outlook.

The injection season, which runs from April 1 through October 31, ended with more than 3,900 Bcf of working gas in storage. That is roughly on par with last year’s starting point and the highest opening winter inventory since 2016. As of October 31, storage stood 4% above the five-year (2020–24) average, the EIA said.

The strong finish is notable because inventories were relatively low at the start of the refill season. Working gas totaled 1,811 Bcf at the end of March 2025, down 21% from March 2024 and 2% below the five-year average for that month.

Above-average injections rebuild cushion

Faced with a slimmer starting point, operators injected more gas than usual this summer to meet their end-of-season targets. Net injections during the April–October period totaled 2,105 Bcf, about 11% more than the five-year average.

Weekly injections ranged from a low of 7 Bcf in early August to a high of 122 Bcf in late May, with more than 100 Bcf injected for seven consecutive weeks from April through June. That pace was supported by record-high U.S. natural gas production during the summer months, the EIA noted.

The combination of strong supply and sustained injections helped rebuild inventories to levels that are broadly in line with last year, despite the lower starting point in March.

Regional storage mostly above norms

Underground storage remains the key balancing mechanism for gas markets during periods of peak demand, particularly in winter. At the start of the 2025–26 heating season, Lower 48 storage sites were 92% full, even after capacity was expanded last year. Each major storage region was at least 86% full as of October 31.

Compared with their respective five-year (2020–24) averages for the end of October, inventories were:

- 20% above average in the Mountain region

- 12% above average in the Pacific region

- 6% above average in the South Central region

- Inventories in the East and Midwest regions were close to their five-year averages, according to the EIA’s Weekly Natural Gas Storage Report.

Those regional balances suggest a relatively well-supplied market as winter begins, with particular strength in western and South Central storage hubs that play an increasingly important role in serving LNG export facilities and power demand.

EIA sees end-winter stocks still above average

Looking ahead, the EIA expects a typical drawdown from storage this heating season but projects that inventories will remain comfortable by spring.

In its November outlook, the agency forecasts withdrawals of more than 1,900 Bcf over the 2025–26 heating season. Even with those pulls, EIA expects working gas in storage at the end of March 2026 to be 9% above the five-year (2021–25) average.

That forecast assumes continued strong U.S. production and typical winter weather. If realized, it would mean the market enters the 2026 injection season with more of a cushion than it had this past spring, reinforcing the role of record domestic output and robust storage operations in meeting growing gas demand from power generation, industry and LNG exports.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM