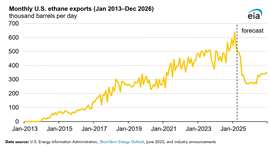

U.S. ethane exports are projected to decline sharply over the next two years following new export licensing requirements imposed by the U.S. Department of Commerce, according to the U.S. Energy Information Administration (EIA).

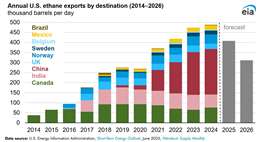

In its June Short-Term Energy Outlook, the EIA forecasts that ethane exports will fall by 80,000 barrels per day (b/d) in 2025 and by 177,000 b/d in 2026. The downward revision is attributed to new restrictions targeting ethane shipments to China, the largest buyer of U.S. ethane.

The licensing requirement, announced by the Commerce Department’s Bureau of Industry and Security (BIS), affects ethane cargoes shipped from Enterprise’s Orbit terminal in Morgan’s Point, Texas, and Energy Transfer’s terminal in Nederland, Texas. Both operators have longstanding supply contracts with Chinese ethylene plants and now must apply for special licenses to continue exporting to China.

According to BIS, ethane shipments to China pose an “unacceptable risk” of being used for military purposes. As a result, the trade has stalled: The last U.S. ethane shipment to China departed May 23 from Energy Transfer’s terminal. As of mid-June, seven Very Large Ethane Carriers (VLECs)—nearly a quarter of the global VLEC fleet—are sitting idle along the U.S. Gulf Coast, EIA said, citing vessel tracking data from Vortexa.

Two of the stalled VLECs are loaded with nearly 1 million barrels of ethane each, and three empty VLECs remain moored offshore, awaiting instructions. Two other vessels typically bound for China have diverted instead to Dahej, India, signaling a significant re-routing of cargoes.

In 2024, China has accounted for 47% of total U.S. ethane exports. Without access to these volumes, China’s ethane-only cracking facilities—such as those operated by Satellite Petrochemical—have reportedly shut down, according to Argus. Some Chinese crackers that can switch feedstocks have transitioned to alternatives such as naphtha or liquified petroleum gas (LPG), including SP Chemical’s facility in Taixing.

Ethane is a natural gas liquid derived from wet gas streams and is primarily used to produce ethylene, a foundational component in the global plastics and synthetic materials industries. Since 2014, U.S. ethane exports have grown steadily—except in 2020—fueled by cost advantages, strong global demand for ethylene, and expanding tanker capacity.

The EIA noted that any policy changes, such as a relaxation of licensing requirements tied to U.S.-China trade negotiations, could reverse the current outlook and lead to an increase in future ethane exports. But absent those developments, U.S. Gulf Coast terminals face mounting supply-chain congestion and uncertain trade flows.