Brazil doubles LNG regasification capacity

October 29, 2025

New terminals support LNG-to-power strategy amid renewable-heavy grid and hydropower risks

According to the U.S. Energy Information Administration (EIA), companies operating in Brazil have more than doubled the country’s liquefied natural gas (LNG) regasification capacity since 2020 as Brazil works to diversify its energy mix and bolster system reliability. Brazil’s import capacity rose from 2.5 billion cubic feet per day (Bcf/d) in 2020 to 5.1 Bcf/d as of August 2025.

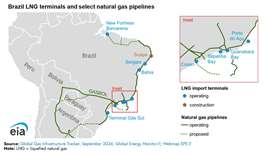

In 2024, three new terminals contributed an estimated 1.74 Bcf/d of capacity: New Fortress Energy’s Barcarena Floating Storage and Regasification Unit (FSRU) at 0.75 Bcf/d, Terminal Gás Sul FSRU at 0.50 Bcf/d, and Compass Gás & Energia’s Cosan terminal at 0.50 Bcf/d. Earlier facilities include the Sepetiba Bay FSRU (0.36 Bcf/d), Porto do Açu FSRU (0.74 Bcf/d), Sergipe FSRU (0.74 Bcf/d), Bahia FSRU (0.71 Bcf/d), and Guanabara Bay FSRU (0.80 Bcf/d).

The Suape FSRU terminal in Pernambuco is under development and is scheduled for completion in early 2026 with an expected capacity of 0.7 Bcf/d.

Integrated LNG-to-power approach accelerates growth

The expansion is aligned with Brazil’s strategy to link each new LNG import terminal with large gas-fired power plants, enhancing flexibility and reliability. At Barcarena, the 2.2-gigawatt Novo Tempo Barcarena power complex is under development, including the CELBA 2 plant, which entered early operations in October. The Port of Açu LNG terminal is paired with the 1.7 GW GNA II gas-fired power plant, which began operations in May.

Regulatory reforms have also played a key role. Under Federal Law 14,182/2021, which included privatizing Eletrobras, Brazil mandated 8 GW of new regionalized gas power-plant contracts. The passage of the New Gas Law (14,134/2021) broke Petrobras’s exclusive control over gas production, transportation, and distribution and enabled independent terminal development and third-party access to gas injection infrastructure.

Strengthening a renewable-rich, hydropower-reliant grid

Brazil’s LNG terminals serve regions without pipeline access and act as backup for a power system heavily dependent on renewable resources. Approximately 80% of Brazil’s power generation comes from hydropower, wind, and solar.

While hydropower accounted for 56% of electricity generation in 2024, droughts can sharply reduce flows and stress the system. In 2024, reservoir levels in key basins fell to 29% of capacity, illustrating the power grid’s vulnerability to dry conditions. Gas-fired plants linked to LNG terminals frequently ramp output in such periods to offset hydropower shortfalls.

In 2024, the United States supplied 72% of Brazil’s LNG imports. Although Brazil has relied heavily on global spot markets to accommodate seasonal consumption swings, the country is shifting toward longer-term contracts to stabilize pricing. Examples include a 15-year supply agreement between Centrica and Petrobras for 0.8 million tons per year starting in 2027, and New Fortress Energy’s long-term contract to support the Barcarena complex’s industrial consumers.

Brazil also imports piped natural gas from Bolivia and Argentina via the GASBOL pipeline, supplementing LNG imports.

In 2024, Brazil’s domestic gas production reached 5.4 Bcf/d, with offshore fields accounting for 85% of output. However, about 54% of that production is reinjected to maintain reservoir pressure, limiting availability for consumption.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM