Read this article in 中文 Français Deutsch Italiano Português Español

Outlook 2026: A Natural Gas and LNG Super Cycle

December 03, 2025

We at ADI predicted an LNG and natural gas “Super Cycle,” showing unprecedented growth earlier this year. But global gas markets didn’t get the memo, with 2025 growth trailing the prior year. That pause is now over. A massive new wave of LNG supply is poised to crash the market in 2026, creating a major inflection point for global gas market. This liquefaction surge will ignite global gas demand, especially in Asia’s price-sensitive regions. It’s excellent news for everyone in the natural gas and LNG value chains, from industrial players to turbomachinery OEMs.

By Uday Turaga and Panuswee Dwivedi

Supply Outlook

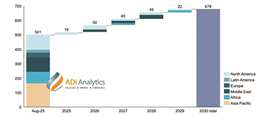

Global LNG supply is forecast to rise about 7% in 2026, outpacing the expected global gas demand growth of about 2%. This expansion marks the start of what ADI is calling a super cycle: global LNG capacity will jump by more than 150 million tons per year (mtpy) by 2030, with Qatar and the U.S. providing approximately two-thirds of the new volume (see exhibit 1). This new liquefaction capacity will need significant feedgas, driving growth in key shale plays in the U.S. and international basins globally. Supply hotspots include:

- Permian associated gas production, which averaged about 20 billion cubic feet per day (Bcf/d) in 2025, urgently needs new pipeline capacity to reach the Gulf Coast. Relief is expected in late 2026; these expansions are vital for containing the extremely low, often negative, prices seen at the Waha trading hub in 2025.

- Haynesville will continue to account for a significant share of new U.S. natural gas supply, with growth here directly linked to new LNG projects. DT Midstream’s LEAP Phase 4 is set to boost capacity, creating a firm path to Gulf Coast LNG plants.

- Despite ample supply in the Marcellus/Utica basin, growth is bottlenecked by downstream transport limits. The major Transco SouthEast Supply Enhancement, needed to fully open the path south, won’t be ready until 2027.

- Outside the U.S., we will see growth in Western Canada. LNG Canada Train 1 is ramping up to its full rate by mid-2026, increasing Western Canadian gas demand by about 2 Bcf/d.

- Beyond North America, the Leviathan field in the Eastern Mediterranean Sea is increasing capacity to 1.5 Bcf/d from early 2026. In Brazil, the Rota 3 pipeline and processing units are boosting marketed gas to local industry and power generation by at least 15% if not more.

Exhibit 1. Global LNG capacity through 2030 by region. (Source: U.S. EIA, IGU, ADI Analytics)

Exhibit 1. Global LNG capacity through 2030 by region. (Source: U.S. EIA, IGU, ADI Analytics)

Demand Hotspots

This new natural gas and LNG supply is expected to trigger price-sensitive demand globally. Asia leads the growth, but new pockets of demand are also appearing in North America. Asian LNG imports are forecast to jump by about 10% in 2026, rebounding from a soft 2025. India is a key hotspot, enabling more imports through infrastructure expansions led by Petronet’s Dahej terminal. In Southeast Asia, countries like Vietnam are investing in floating storage and regasification units (FSRUs) to boost new gas-to-power capacity by potentially 20 GW.

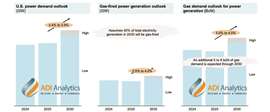

Europe still needs significant LNG, and demand is expected to grow around 5% in 2026 to refill storage and replace Russian pipeline gas. Europe’s plan to stop buying Russian LNG by the end of 2026 will keep demand for Atlantic cargoes high. A new, long-term factor is the massive building spree for AI-led data centers across the U.S. (see exhibit 2). This huge new electric load relies on gas generation, leading to pipeline expansions that compete directly with LNG exports for U.S. natural gas. While international benchmark LNG prices (e.g., JKM and TTF) will likely soften, this should make LNG more affordable for price-sensitive emerging markets, encouraging them to switch away from fuels like fuel oil and coal and thereby drive additional demand.

Exhibit 2. Data center-driven power and natural gas demand growth in the U.S. (Source: U.S. EIA, company presentations, ADI Analytics)

Exhibit 2. Data center-driven power and natural gas demand growth in the U.S. (Source: U.S. EIA, company presentations, ADI Analytics)

Shipping Faces New Hurdles

While the gas supply picture is improving, issues with shipping logistics and trade policy are creating new difficulties. Red Sea security remains a high risk, forcing shippers to use the longer Cape routings, keeping LNG transits through the Suez Canal far below historical norms. Panama Canal slot capacity has returned to normal. The global fleet of LNG carriers is set to grow with about 300 LNGCs delivering across 2025–2027. Crucially, most of this capacity is already committed to long-term contracts, which limits the flexibility of the spot market even as supply increases. Finally, the U.S. is requiring that a growing share of its LNG exports must use U.S.-built ships (starting at 1% in 2029), which could shift future vessel orders toward Korean yards.

Pricing Convergence?

The supply surge will heavily impact global pricing by moderating regional price extremes and providing new momentum for the idea of convergence across regional pricing hubs. This is uncertain, although ADI’s models expect relatively moderate price outlooks globally, with Henry Hub expected to be a little short of $4.00 per million Btu through 2026. Lower, converging prices will reduce the profit in the arbitrage trade, especially as the JKM-TTF spread is near zero. The risk of insufficient arbitrage, coupled with data center demand, could depress the arbitrage and limit the financial viability of new LNG export projects.

Turbomachinery Sector Implications

The confluence of robust LNG project sanctioning, accelerating gas-fired power additions, and surging data-center electricity demand underpins a durable runway for turbomachinery suppliers to achieve revenue growth rates in the mid-single to low-double-digit range through 2030. The strongest demand is for large equipment, skewed toward heavy-duty F/H-class and aeroderivative gas turbines for mechanical drive and power generation, alongside large centrifugal compressors for new liquefaction projects. Reciprocating compressors also have opportunities which may expand as backlogs plague other preferred compression options.

OEMs are responding with strategic capacity expansions, such as Siemens Energy’s planned 30-60% increase in gas turbine output and GE Vernova’s 5 GW capacity addition by mid-2026. Companies that scale manufacturing judiciously, extend service offerings, and tailor portfolios to efficiency and fuel-flexibility requirements are positioned to capture share in the coming cycle.

Conclusion

The year 2026 will test the global gas market. The new wave of supply will provide crucial security and lower prices, but how smoothly this massive volume is moved and consumed, from fixing pipelines out of the Permian to building terminals in Asia, will define the market for the rest of the decade.

About ADI Analytics

ADI Analytics is a prestigious, boutique consulting firm specializing in oil and gas, energy, chemicals, and industrials since 2009. We bring deep expertise in a broad range of markets where we support Fortune 500, mid-sized and early-stage companies, and investors with consulting services, research reports, and data and analytics, with the goal of delivering actionable outcomes to help our clients achieve tangible results.

ADI has supported a wide range of industrial companies and turbomachinery OEMs with market intel, product and service strategy, customer segmentation, installed base and aftermarket growth, and M&A due diligence.

We also host the ADI Forum that brings c-suite executives together for meaningful dialogue and strategic insights across the oil & gas, energy transition, and chemicals value chains. Learn more at www.adi-analytics.com.

About the authors

Uday Turaga

Uday Turaga

Uday Turaga is Founder & CEO of ADI Analytics. Through 25 years of industry experience gained at ExxonMobil, ConocoPhillips, Booz, and ADI, Turaga brings deep commercial and technical expertise in energy, chemicals, and industrials. He holds a PhD in fuel science from Penn State and an MBA from the University of Texas at Austin. In addition to authoring over 100 papers and two U.S. patents, he has been recognized by the U.S. National Academy of Engineering and featured in the Wall Street Journal.

Panuswee Dwivedi is a project manager at ADI Analytics. She brings experience in the oil and gas upstream, midstream, and downstream sectors and in commodity and specialty polymers markets. She holds a master’s degree in petroleum engineering from the University of Houston, and a bachelor’s degree in petroleum engineering from the Pandit Deendayal Energy University in India, with experience in production engineering at ONGC.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM