Read this article in Français Deutsch Italiano Português Español

Carbon capture infrastructure gains global traction despite policy headwinds

October 09, 2025

CCS transport and storage networks expand as investment models mature and governments refine regulatory pathways

A year of mixed policy signals has not slowed the global buildout of carbon capture and storage (CCS) infrastructure. According to the Global Status of CCS 2025 report released in October by the Global CCS Institute, the number of CCS facilities in operation has jumped 54% in the past year to 77, with total capture capacity reaching 64 million tonnes per annum (Mtpa). Another 44 Mtpa is under construction, representing a near-term 70% increase in global operating capacity once those projects come online.

Behind those numbers is a rapid shift toward midstream buildout — pipelines, storage hubs, shipping networks and shared CO₂ transport corridors — that is beginning to define the next phase of industrial decarbonization. The Institute calls this a “new phase of financial maturity,” marked by the first non-recourse debt financing of CCS networks, growing private-sector participation, and steady policy progress across several regions.

“Dedicated CO₂ transport and storage projects are increasing — doubling in Europe between 2023 and 2024 alone — laying the foundation for shared CCS networks that improve scalability and reduce costs,” said Jarad Daniels, CEO of the Global CCS Institute. “Projects like the East Coast Cluster in the UK, Saudi Arabia’s Jubail CCS hub, and Norway’s Longship initiative are setting the standard for integrated CCS networks.”

Building the backbone of carbon management

The global CCS industry has now reached a total of 734 projects in various stages of development — from early concept to operation — an increase of 17% in just one year. This expanding pipeline is anchored by transport and storage projects, which are emerging as the backbone of the carbon management value chain.

As more emitters seek access to storage without developing their own capture systems, dedicated CO₂ networks are taking shape across key industrial regions. Europe leads the trend: its number of transport and storage projects has doubled in the past year, helped by regulatory clarity under the European Union’s Net-Zero Industry Act (NZIA) and coordinated national support in countries such as the UK, Denmark, and the Netherlands.

The UK’s long-awaited financial close for its Net Zero Teesside and Northern Endurance Partnership projects — backed by bp, Equinor and TotalEnergies — marked the first full-chain CCS project financing in Europe. Together, the two projects secured roughly £8 billion in debt financing to build CO₂ transport pipelines, offshore storage sites in the Southern North Sea, and a 742-MW gas-fired power plant with capture capability.

“These transactions mark a major milestone in mobilizing private capital for UK CCS deployment,” the Institute noted, adding that similar institutional financing is now being explored in Norway and Denmark.

In parallel, Europe’s first dedicated CO₂ shipping vessel was launched in May 2025 to serve Denmark’s Project Greensand, signaling the start of a maritime segment expected to expand quickly. The Institute plans to publish a separate study later this year on the “needs, opportunities and prospects” for CO₂ shipping in CCS value chains.

Financial maturity and new investment models

Infrastructure development has historically been the bottleneck for CCS, but that is changing as financial instruments and risk structures mature. Non-recourse debt financing — long a standard for renewable energy projects — is now being applied to CCS. The Net Zero Teesside and Northern Endurance projects demonstrated that with government-backed offtake mechanisms and clear storage regulation, private lenders are willing to participate at scale.

In May, Italy’s Eni partnered with Global Infrastructure Partners to co-own CCS assets across the UK, Netherlands and Italy, signaling broader institutional investor appetite. Meanwhile, the European Commission’s Innovation Fund and the Connecting Europe Facility for Energy continue to provide billions in public funding to complement private investment.

The Institute said the emergence of standardized contracts, dedicated insurance products and project finance structures are helping de-risk CCS networks and bring them closer to parity with other infrastructure classes.

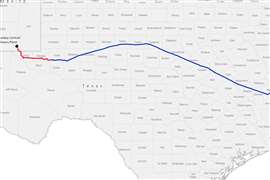

In the Americas, similar patterns are beginning to emerge. The U.S. still leads in total CCS projects, with 39 facilities operating and more than 180 in various stages of development. While federal policy remains in flux following the announced rollback of certain Biden-era climate measures, the bipartisan 45Q tax credit continues to drive investment.

The “One Big Beautiful Bill Act” passed earlier this year preserved the $85-per-ton credit for point-source capture and $180-per-ton credit for direct air capture (DAC), while expanding eligibility to CO₂ utilized or injected in enhanced oil recovery or gas recovery projects. For midstream developers, that means new revenue potential for shared transport and storage infrastructure that supports multiple capture sites and end users.

North American states take the lead

State-level initiatives are proving just as important as federal incentives. In 2025, 12 U.S. states passed 24 carbon management laws, with Louisiana, North Dakota, West Virginia and Wyoming now possessing authority to issue CO₂ injection permits under the federal Underground Injection Control program. Arizona and Texas are expected to follow later this year.

Louisiana has emerged as a leading case study in how CCS infrastructure can serve both climate and economic goals. The Institute’s modeling suggests that $29.5 billion in carbon management investments — supported by 45Q credits and state incentives — could generate $90 billion in economic value over two decades and support about 120,000 direct and indirect jobs annually.

The state’s dense concentration of industrial emissions, existing pipeline corridors, and proximity to Gulf Coast storage formations make it a prime hub for CO₂ transport and sequestration. Companies such as ExxonMobil, Air Products and Denbury (now part of ExxonMobil Low Carbon Solutions) are already advancing major storage and transport projects in the region.

Canada continues to reinforce its own policy framework with the extension of its federal carbon capture, utilization and storage (CCUS) tax credit through 2035. Several large-scale projects — including the Pathways Alliance oil sands CCS network — are approaching final investment decisions. Together, these developments suggest North America will remain central to global CCS expansion in the near term.

Linking global markets through CO₂ transport

Transboundary CO₂ movement is becoming an increasingly important element of the CCS market. The 2009 amendment to the London Protocol — which enables cross-border CO₂ transport for storage — has now been ratified or provisionally applied by several additional nations in the past year.

Europe is leading the way with new bilateral and multilateral agreements. Norway and Switzerland signed one of the first Article 6.2 frameworks for international carbon removals under the Paris Agreement. Greece and Egypt concluded the Mediterranean’s first memorandum of understanding on CCUS cooperation, while France and Norway signed a bilateral CO₂ transport and storage deal.

In Asia, cross-border CCS cooperation is taking shape among Japan, Indonesia, Malaysia, and Australia, which are negotiating frameworks for shared storage access. Indonesia and Malaysia have enacted new laws allowing third-party nations to export CO₂ for sequestration — a key step toward regional carbon management networks that could eventually link emitters across Southeast Asia with offshore storage in neighboring waters.

These agreements are essential to unlocking the economies of scale required for global CCS deployment, the Institute said. Shared pipelines, shipping terminals and offshore storage hubs can dramatically reduce costs for individual emitters while expanding access to sequestration capacity.

Demand from new sectors reshapes priorities

The rise of energy-intensive data centers — particularly those powering artificial intelligence — is emerging as an unexpected growth driver for CCS-ready power generation. The Institute projects that 55 GW of new data center capacity will come online in the U.S. by 2030, with about 30% incorporating on-site generation to avoid grid bottlenecks.

Natural gas combined-cycle (NGCC) plants equipped with CCS are increasingly viewed as a viable way to provide firm, low-carbon electricity to these facilities. The Institute’s analysis found that NGCC with CCS ranks among the lowest-cost dispatchable power options when federal tax credits are included, rivaling or beating the cost of unabated natural gas and nuclear generation.

Wyoming recently announced a major AI data center that will be powered by natural gas with CCS, consuming more electricity than the state’s current total demand. Similar projects are being proposed in Alberta, Texas and Louisiana, where CO₂ transport and storage infrastructure is already being built.

Outlook: staying the course

Despite progress, the Institute cautions that current project pipelines still fall short of what’s needed to meet global climate goals. Even if all announced projects reach operation, total capture capacity by 2030 would reach about 337 Mtpa — far below the gigatonne-scale deployment required for the Paris Agreement targets.

Daniels said that continued policy support, clear regulatory frameworks and cross-sector collaboration will be critical to sustaining investment. “While the road ahead is not without challenges, recent advances in transport and storage infrastructure demonstrate that CCS is entering a new phase of industrial maturity,” he said. “In the face of uncertainty, it is more important than ever that we stay the course.”

For the midstream industry, that course increasingly runs through CO₂ pipelines, storage hubs, and shipping terminals — the connective tissue of a global carbon management system that is finally taking shape.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM