Read this article in Français Deutsch Italiano Português Español

Gas turbine surge creates new bottlenecks for Midstream infrastructure

October 08, 2025

AI-driven power demand fuels a boom in gas generation projects — and exposes critical gaps in turbine supply and skilled labor

According to a new Mitsubishi Power report, “Gas Stampede Puts Spotlight on Turbine Supply Chain,” the company’s 10-year forecast for large gas turbines in the U.S. has nearly doubled within a year.

According to a new Mitsubishi Power report, “Gas Stampede Puts Spotlight on Turbine Supply Chain,” the company’s 10-year forecast for large gas turbines in the U.S. has nearly doubled within a year.

Gas turbine manufacturers are racing to expand production as surging U.S. electricity demand — largely from artificial intelligence (AI) data centers — drives an unexpected boom in gas-fired generation. For the Midstream natural gas industry, the expansion signals both opportunity and strain as pipelines, compression capacity, and plant construction resources struggle to keep up.

According to Mitsubishi Power’s recent report “Gas Stampede Puts Spotlight on Turbine Supply Chain,” the company’s 10-year forecast for large gas turbines in the U.S. has nearly doubled within a year. “A couple of years ago, we analyzed the market orders from the previous decade and observed a consistent market of approximately 7.5 to 8 gigawatts per year,” said Todd Brezler, senior vice president of digital transformation and marketing at Mitsubishi Power. “Now Lawrence Berkeley National Lab predicts U.S. power demand from data centers could double or triple by 2028.”

That translates to as much as 132 GW of new generating capacity — much of it fueled by natural gas. For the Midstream sector, the implications are significant: transporting and processing volumes could rise sharply as new combined-cycle and peaking plants come online across multiple regions.

Manufacturing strain meets pipeline opportunity

Mitsubishi Power, Siemens Energy and GE Vernova — together responsible for two-thirds of gas turbine capacity under construction worldwide — are all expanding production, the report said. Each has announced plans to boost output by 25% to 35% annually starting in 2026.

Even so, the backlog is staggering. Siemens Energy reported in August that its global order book had reached a record €136 billion, driven in large part by gas turbine demand for data centers. About 60% of Siemens’ 2025 gas turbine orders are tied to data center projects, according to the Financial Times. Wait times for new gas-fired turbine equipment have stretched as long as five to seven years, depending on the model and project location, S&P Global Commodity Insights reported.

GE Vernova faces similar pressures. The company said its delivery slots for 2026 and 2027 are largely sold out, with a turbine order backlog approaching 30 GW and another 20 GW in reservation agreements, according to Axios. To meet demand, GE Vernova is expanding its Greenville, South Carolina, manufacturing facility and recently acquired Woodward Inc.’s heavy-duty gas turbine combustion parts business to secure domestic component supply.

Even with these moves, the supply chain remains tight. “A gas turbine by itself does not make up a power plant,” Brezler said. “You’ve got the steam turbine, the generators, the transformers, and the switchgear — and only so much skilled labor that can work on power plant equipment.”

For Midstream companies, these constraints could delay project timelines but also create opportunities for service and logistics providers. Compression service companies and EPC contractors with energy-sector experience may find themselves in higher demand as power developers seek to accelerate project delivery or manage interim gas flows during construction.

Gas demand defies global decarbonization trends

Despite forecasts from the International Energy Agency showing fossil fuel demand peaking before 2030, natural gas consumption in North America remains strong. The Mitsubishi Power report noted that U.S. policy continues to favor domestic production and exports, reinforcing gas’s role as a backbone fuel for the power sector.

That trend sits uneasily beside corporate decarbonization goals. Major AI developers such as Google and Microsoft have both seen emissions rise due to power-intensive data workloads, even as they maintain commitments to carbon neutrality. Their growing electricity demand is forcing utilities — and the gas network behind them — to build capacity faster than renewable projects can fill the gap.

The result: a short- to mid-term resurgence in gas plant construction, with natural gas positioned as the most flexible and readily available fuel to backstop renewable intermittency.

Technology evolution supports long-term decarbonization

Gas turbine makers are framing their technology as a bridge to a lower-carbon future. “Today’s gas plant technology is well proven to take alternative fuels,” said Peter Sawicki, Mitsubishi Power’s vice president for emerging technologies, noting that turbines can transition to hydrogen or other low-carbon fuels at modest incremental cost.

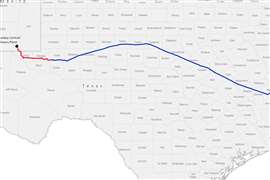

Meanwhile, carbon capture and storage (CCS) remains a key complementary path. The Mitsubishi Power report cites Houston-based Low Carbon Infrastructure’s gas-fired plant in Decatur, Illinois, which is designed to capture more than 90% of its emissions. Such projects point to a future where Midstream infrastructure may expand to handle CO₂ as well as methane — integrating new compression, dehydration and storage facilities along the way.

Midstream players eye service and logistics gains

To meet near-term needs, Mitsubishi Power recently opened a 120,000-square-foot distribution center in Orlando, Florida, to manage turbine parts and logistics for its growing U.S. fleet. Its smaller aero derivative turbines — including the modular FT8 MOBILEPAC — can be deployed rapidly and may appeal to operators needing fast-track power for pipeline stations, LNG terminals or remote industrial loads.

“You can build from a size of tens of megawatts to gigawatts, and you’re going to achieve a lower cost of energy compared to alternatives,” said Don Daniels, Mitsubishi Power’s chief strategy officer. “When you couple that with renewables and storage, you now have a system that drives down both cost and carbon intensity.”

For the Midstream market, the gas turbine “stampede” described in the Mitsubishi Power report — and reinforced by recent statements from Siemens Energy and GE Vernova — underscores a pivotal shift. Natural gas, once seen as a transitional fuel, is again being treated as essential infrastructure linking upstream production to downstream electrification. The challenge now lies in delivering enough compression, pipeline capacity and technical labor to ensure the power sector’s next growth phase can actually materialize.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM