Read this article in 中文 Français Deutsch Italiano Português Español

North American LNG export capacity set to more than double by 2029

October 20, 2025

U.S. projects dominate growth as new terminals rise in Canada and Mexico

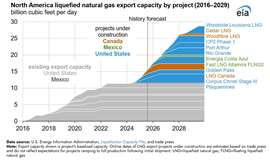

Liquefied natural gas (LNG) developers across North America are on track to more than double the region’s export capacity by the end of the decade, led by a new wave of large-scale projects on the U.S. Gulf Coast.

According to the U.S. Energy Information Administration’s Liquefaction Capacity File and trade press reports, U.S. LNG exporters have announced plans to add about 13.9 billion cubic feet per day (Bcf/d) of new capacity between 2025 and 2029. The United States, already the world’s largest LNG exporter, currently has 15.4 Bcf/d of installed capacity.

Taken together, LNG export capacity in North America is projected to climb from 11.4 Bcf/d at the start of 2024 to 28.7 Bcf/d in 2029, if all projects under construction begin operating as scheduled. That expansion would account for more than half of all new LNG capacity expected globally through 2029, according to the International Energy Agency.

U.S. expansion centered on Gulf Coast

Most of the new U.S. capacity will be concentrated along the Gulf Coast, where developers continue to build new liquefaction trains and marine terminals to meet global demand. The region is already the largest export hub in the Atlantic Basin.

Plaquemines LNG Phase 1 shipped its first cargo in December 2024, while Plaquemines Phase 2 and Corpus Christi Stage III began cargo shipments earlier this year, though neither has yet entered full commercial service.

Five additional U.S. export projects have reached final investment decision (FID) and are now under construction:

- Port Arthur LNG Phase 1 (1.6 Bcf/d)

- Rio Grande LNG (2.1 Bcf/d)

- Woodside Louisiana LNG (2.2 Bcf/d)

- Golden Pass LNG (2.1 Bcf/d)

- CP2 LNG Phase 1 (2.0 Bcf/d)

To feed these terminals, developers are advancing new pipeline projects to move gas from major producing regions to the Gulf Coast. However, permitting and construction delays remain a potential constraint for supply growth.

Canada enters export market

Canada officially joined the ranks of LNG exporters in mid-2025 when LNG Canada shipped its first cargo from Train 1 in Kitimat, British Columbia. The facility, the country’s first LNG export terminal, can produce a combined 1.84 Bcf/d from its two liquefaction trains and is expected to reach full capacity in 2026.

A proposed second phase would double that capacity to 3.68 Bcf/d by adding two additional trains, though the expansion is not expected online until after 2029, according to the Canada Energy Regulator.

Canada’s west coast LNG terminals are strategically positioned to serve Asian markets, with transit times about 50% shorter than from U.S. Gulf Coast terminals. The projects will draw feedgas primarily from the prolific Montney Formation in Alberta and British Columbia.

Two other projects are also under construction in Western Canada:

- Woodfibre LNG (0.3 Bcf/d), expected online in 2027

- Cedar LNG (0.4 Bcf/d), a floating facility that reached FID in June 2024 and is scheduled to begin exports in 2028

Mexico emerges as new export route

Mexico’s LNG export sector is also taking shape, supported largely by U.S. natural gas supplies. Two projects now under construction will add a combined 0.6 Bcf/d of export capacity by the end of the decade.

The Fast LNG Altamira floating production vessel (FLNG2) on Mexico’s east coast will provide 0.2 Bcf/d of liquefaction capacity, while Energía Costa Azul on the west coast will contribute 0.4 Bcf/d.

Mexico’s first LNG cargo was produced in August 2024 from the Fast LNG Altamira FLNG1 vessel, which sources feedgas via the Sur de Texas–Tuxpan pipeline from the United States.

Outlook: A global supply shift

If completed as planned, the North American LNG buildout would add more than 17 Bcf/d of new export capacity by 2029, cementing the region’s dominance in global LNG trade. The surge in supply capacity reflects continued demand growth from Europe and Asia, where buyers are seeking long-term contracts for reliable, lower-carbon energy sources.

The expansion also underscores the shifting geography of LNG exports—anchored by the U.S. Gulf Coast, supported by new routes through Mexico, and extended to the Pacific via Canada’s west coast. Together, these developments are set to redefine global gas flows over the next decade.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM