Read this article in Français Deutsch Italiano Português Español

Another Permian merger announced

February 12, 2024

Diamondback, Endeavor Energy in $27 billion deal

Diamondback Energy and Endeavor Energy Resources said they would merge in a US$26 billion deal. (Image: Endeavor Energy Resources)

Diamondback Energy and Endeavor Energy Resources said they would merge in a US$26 billion deal. (Image: Endeavor Energy Resources)

Diamondback Energy and Endeavor Energy Resources will merge in a transaction valued at US$26 billion, inclusive of Endeavor’s net debt.

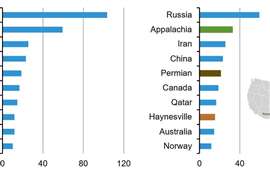

The combination will create a premier Permian independent operator, the companies said.

“This is a combination of two strong, established companies merging to create a ‘must own’ North American independent oil company,” said Travis Stice, chairman and CEO of Diamondback. “This combination meets all the required criteria for a successful combination: sound industrial logic with tangible synergies, improved combined capital allocation and significant near and long-term financial accretion. With this combination, Diamondback not only gets bigger, it gets better.”

The merger will combine approximately 838,000 net acres and 816 MBOE/d of net production.

Diamondback expects operational synergies to be realized in 2025 by the combined company. The 2025 plan is preliminary and subject to changes, including as result of changes in oil and gas prices, the macro environment and well costs.

On a pro forma basis in 2025, Diamondback expects to generate oil production of 470 – 480 MBO/d (800 – 825 MBOE/d) with a capital budget of approximately $4.1 - $4.4 billion.

This operating plan implies significant pro forma cash flow and free cash flow per share accretion.

The combined company will continue to be headquartered in Midland, Texas. Diamondback expects the merger to close in the fourth quarter of 2024, subject to the satisfaction of customary closing conditions, including termination or expiration of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, and approval of the transaction by the Company’s stockholders.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM