Read this article in Français Deutsch Italiano Português Español

Three U.S. regions each produce more natural gas than most countries

November 07, 2025

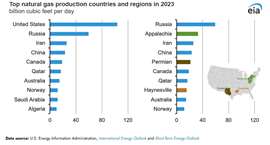

Appalachia, Permian and Haynesville rank among the world’s largest supply sources

Three U.S. natural gas-producing regions individually rank among the largest natural gas producers in the world, according to new data from the U.S. Energy Information Administration (EIA). When measured against the production levels of entire countries, the Appalachia, Permian and Haynesville regions each exceed the output of most national producers.

The Appalachia region, which includes the Marcellus and Utica shale plays across Pennsylvania, Ohio and West Virginia, produced 33 billion cubic feet per day (Bcf/d) of natural gas in 2023. That level of supply made Appalachia the second-largest natural gas-producing area globally when compared independently to other countries. Production in the region has remained steady at about 33 Bcf/d during the first half of 2025.

The Permian Basin in Texas and New Mexico ranked fifth among global production sources at 21 Bcf/d in 2023. Output there has continued to climb, averaging about 25 Bcf/d in the first half of 2025, driven largely by associated gas production from oil-directed drilling.

The Haynesville region, spanning parts of Texas, Louisiana and Arkansas, ranked eighth worldwide at 15 Bcf/d in 2023. Production has edged slightly lower to about 14 Bcf/d so far in 2025, reflecting a slowdown in drilling during periods of lower natural gas prices.

Together, these three U.S. regions supply more natural gas than nearly all other individual producing countries, highlighting the scale of U.S. unconventional development and the concentration of domestic output in a handful of prolific basins.

EIA noted that continued investment in pipelines, gathering systems and LNG export capacity will play a key role in shaping production trends in the coming years. Ongoing expansion of Gulf Coast liquefaction facilities is expected to influence both Permian and Haynesville development, while Appalachia output remains closely tied to takeaway constraints and regional market access.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM