Read this article in Français Deutsch Italiano Português Español

Gas-fired power: turbocharged potential meets turbo lag reality

May 16, 2025

New report outlines strong demand but warns of headwinds through 2040

A surge in global demand for gas-fired power generation is underway, with gas turbine orders rising 32% year-on-year in 2024, according to a new analysis by Wood Mackenzie. The consultancy says the market is entering a “gold rush” phase, driven by soaring electricity needs and the global transition away from coal. But despite this bullish demand outlook, the sector faces significant structural hurdles that could slow growth over the next 15 years.

In its report, Turbocharged vs turbo lag: the new landscape for gas-fired power, Wood Mackenzie says the gas power industry is at a pivotal moment. While gas offers the dispatchability needed to balance variable renewables, supply chain constraints, rising capital costs, and shifting policy dynamics could create a prolonged period of “turbo lag.”

Growth driven by global energy needs

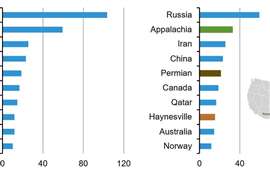

Natural gas remains a key transitional fuel in many regions. In the U.S., gas-fired capacity is expected to grow at a record pace through 2040, in part due to its role supporting data center loads tied to artificial intelligence (AI) expansion. Germany plans to add 20 GW of new gas generation by 2030 as it exits coal and nuclear. Meanwhile, Southeast Asia, the Middle East, and Africa all anticipate robust gas power growth to meet rising electricity demand.

China is leading gas buildout in Asia Pacific, though its overall share of generation remains modest compared to coal. Japan and South Korea are turning to gas to replace aging fleets, while Latin America is deploying gas to support renewables and manage peak demand.

Turbo lag: manufacturing and cost constraints

Despite this broad interest, real-world bottlenecks are emerging. Global turbine manufacturing capacity is expected to be nearly fully utilized by 2025, with long lead times already pushing online dates for new U.S. combined-cycle plants into the next decade.

Rising capital costs add to the strain. In the U.S., costs for new combined-cycle plants have reached historic highs, exacerbated by reciprocal tariffs. Wood Mackenzie forecasts capital costs could hit $2,800/kW by 2028. This puts developers in a bind as wholesale power prices in many markets remain below the cost of new gas generation.

In Asia Pacific, high LNG import prices have eroded gas competitiveness. Policymakers remain cautious after the 2022 price spikes following the Russia–Ukraine conflict. Most markets in the region now view gas primarily as a peaking resource, with renewables and coal maintaining dominance for baseload.

Europe is moving in a different direction. There, carbon pricing and aggressive decarbonization policies are pushing unabated gas to the margins. Growing energy storage and demand response capabilities further challenge the role of gas as a balancing fuel.

Post-2030 outlook hinges on infrastructure and innovation

Looking out to 2030–2040, the future of gas-fired generation may depend on several unresolved factors. One is the pace and scale of data center growth, particularly in North America. While AI-related demand has been a key narrative supporting new build activity, recent project cancellations by major tech companies raise questions about its longevity.

The industry’s willingness to invest in additional manufacturing capacity also remains uncertain. After multiple boom-bust cycles, turbine makers are reluctant to expand without clear, long-term demand signals.

Emerging technologies such as carbon capture and storage (CCUS) and hydrogen blending offer potential lifelines for gas power under climate constraints. But Wood Mackenzie notes that the levelized cost of electricity (LCOE) from CCUS-equipped gas remains materially higher than unabated gas, and commercial deployment is still in its infancy.

Finally, midstream infrastructure presents a critical bottleneck. In the U.S., permitting and community opposition continue to stall pipeline and compression projects. Across Asia, major investments are needed in regasification terminals, pipelines, and gas storage to support future power sector growth.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM