Read this article in Français Deutsch Italiano Português Español

Venture Global advances CP2 LNG project

May 13, 2025

FERC gives final environmental nod

Venture Global said its Calcasieu Pass facility will commence commercial operations on April 15.

Venture Global said its Calcasieu Pass facility will commence commercial operations on April 15.

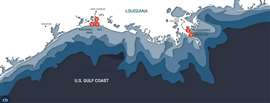

Venture Global LNG reached a key regulatory milestone as the Federal Energy Regulatory Commission (FERC) issued its Final Supplemental Environmental Impact Statement (FSEIS) for the company’s proposed CP2 LNG export terminal in Louisiana. The report supports project approval and positions CP2 to move closer to a final investment decision (FID).

The FERC decision caps a flurry of progress for CP2, Venture Global’s third U.S. liquefied natural gas facility. The company secured U.S. Department of Energy approval in March to export LNG from CP2 to nations without free trade agreements. It also closed a $3 billion credit facility on May 1 with backing from 20 global banks to support manufacturing, procurement, and engineering work on the terminal.

“These are major steps toward FID,” said Mike Sabel, CEO of Venture Global. “With CP2 advancing and our other projects exceeding performance expectations, we are well positioned to meet growing global LNG demand.”

The CP2 project is part of Venture Global’s broader strategy to develop over 100 million tonnes per annum (MTPA) of LNG capacity. The company’s first project, Calcasieu Pass, officially began commercial operations on April 15 and has since delivered cargoes on schedule to all foundational customers. Meanwhile, 18 liquefaction trains at the Plaquemines LNG project, Venture Global’s second terminal, are already producing at 140% of nameplate capacity.

These performance gains are enabling Venture Global to serve an increasingly competitive global market, where LNG buyers seek flexibility, speed, and supply security amid geopolitical tensions and demand growth in Asia and Europe.

In total, Venture Global exported a record 234 trillion British thermal units (TBtu) of LNG in the first quarter, nearly double the volume shipped in the fourth quarter of 2024. Looking ahead, the company expects to export between 145–150 cargoes from Calcasieu and 222–239 cargoes from Plaquemines in 2025.

While financial results for the quarter were robust—driven by higher LNG volumes and pricing—Sabel emphasized project execution over profitability. The company generated $2.9 billion in revenue, up 105% year-over-year, and posted $1.3 billion in consolidated adjusted EBITDA, a 94% increase. Net income fell 39% to $396 million, a decline attributed to non-cash impacts from interest rate hedging.

Despite some compression in the spread between domestic and international gas prices, Venture Global reaffirmed its full-year 2025 EBITDA guidance of $6.4–$6.8 billion, assuming liquefaction fees of $6–$7 per MMBtu for unsold cargoes. A $1 change in that range would impact earnings by as much as $480 million.

Sabel said the company remains committed to long-term growth, including carbon capture and sequestration initiatives at all facilities. “We’re not only expanding our LNG production capacity, but also building the infrastructure to support a lower-carbon energy future.”

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM