Read this article in 中文 Français Deutsch Italiano Português Español

Delfin advances toward FID for first U.S. deepwater FLNG project

October 23, 2025

Agreement with Samsung Heavy Industries secures construction path for multiple floating LNG vessels

Delfin Midstream Inc. has taken another major step toward a final investment decision (FID) on its flagship floating LNG (FLNG) project offshore Louisiana, announcing that it has entered into a Letter of Award (LOA) with Samsung Heavy Industries (SHI) for the engineering, procurement, construction, and installation of the project’s first FLNG vessel.

Under the agreement, SHI will serve as the exclusive EPCI contractor for Delfin’s first vessel and will reserve exclusive use of its dock facilities for the project’s construction. The companies will immediately begin early engagement activities, mobilizing project teams and de-risking the overall schedule in preparation for execution.

Delfin expects to reach FID on the first FLNG vessel in November 2025. The company said the LOA also paves the way for subsequent expansion, including a second vessel FID targeted for early 2026 and a framework for future collaboration on a third unit. The second vessel’s dock reservation has already been secured as part of the new agreement, ensuring continuity in construction and delivery timelines.

Earlier in 2025, Delfin locked in manufacturing capacity for its gas turbines from Siemens Energy Inc., a key milestone in project development. The company has also made substantial progress on both debt and equity financing, positioning the project for near-term execution.

“We are very pleased with the commercial and financing workstreams closing in for an FID on the Delfin LNG project,” said Dudley Poston, CEO of Delfin Midstream. “With this LOA we further strengthen our construction pathway—not just for the first, but also for the second and third FLNG vessels. The Delfin project also fosters increased cooperation in trade, energy and shipbuilding between the Republic of Korea and the United States.”

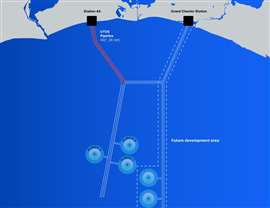

Delfin’s floating LNG concept leverages a brownfield deepwater port that requires minimal additional infrastructure investment to support up to three FLNG vessels with a combined capacity of 13.2 million tonnes per year (MTPA). Once in operation, the project would become the first LNG export deepwater port facility in the United States, designed to provide flexible, low-cost export capacity while contributing to regional economic growth and job creation.

Based in Houston, Delfin Midstream is the parent company of Delfin LNG, which holds a U.S. Maritime Administration (MARAD) deepwater port license and Department of Energy approval to export LNG to both free-trade and non-free-trade countries. The company also owns the UTOS pipeline, the largest natural gas pipeline in the Gulf of Mexico, which will connect directly to its offshore FLNG assets.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM