Read this article in 中文 Français Deutsch Italiano Português Español

JERA expands U.S. energy footprint with Haynesville Shale acquisition

October 23, 2025

Deal strengthens LNG supply chain and deepens Japan–U.S. energy cooperation

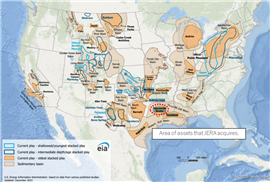

JERA Co. Inc., Japan’s largest power generation company and one of the world’s leading LNG buyers, is expanding its North American presence with a major upstream acquisition in the Haynesville Shale. Through its U.S. subsidiary, JERA Americas Inc., the company has reached an agreement with Williams and GEP Haynesville II, LLC to acquire 100% of their respective interests in the South Mansfield upstream asset in western Louisiana.

The $1.5 billion transaction marks a significant step in JERA’s long-term strategy to build a diversified and resilient global energy portfolio. The Haynesville asset currently produces more than 500 million cubic feet per day (MMscfd) of natural gas and includes about 200 undeveloped drilling locations. JERA plans to increase total production to approximately 1 billion cubic feet per day (Bscfd) under a future investment program.

The South Mansfield property offers both scale and strategic value, featuring proven reserves, existing gathering and treating infrastructure, and proximity to the Gulf Coast’s LNG export and data center corridors. The location will allow JERA to strengthen its U.S. gas production base and support growing LNG export volumes from the region.

“The U.S. energy sector is leading the way in the global LNG market and JERA’s investments have lined up accordingly,” said John O’Brien, chief executive officer of JERA Americas. “The upstream Haynesville acquisition is a strategic addition to our asset portfolio, enabling us to advance our unique supply chain expertise while deepening our commitment to America’s energy future.”

Ryosuke Tsugaru, JERA’s chief low carbon fuel officer, said the deal enhances both the company’s diversification and its integration across the gas value chain. “The Haynesville acquisition substantially expands our partnerships in the United States,” Tsugaru said. “The benefits are clear: enhanced diversification for JERA’s LNG value chain, expanded global reach, and overall risk mitigation in a volatile energy market. The project clearly aligns with our strategic priorities and reinforces our mission to provide a stable and secure energy supply globally.”

The acquisition builds on JERA’s rapidly growing U.S. portfolio, which includes ownership stakes in 10 power generation assets and the recently announced Blue Point low-carbon ammonia development project. Earlier this year, JERA also signed one of the largest LNG offtake agreements ever executed by a single buyer in the U.S.—5.5 million tonnes per year for 20 years—further cementing its role as a key participant in the global LNG market.

The Haynesville transaction remains subject to customary closing conditions and regulatory approvals.

Headquartered in Tokyo, JERA produces roughly one-third of Japan’s electricity and operates across the entire LNG value chain—from upstream participation and fuel procurement to transport and power generation. Established in 2015, the company has pledged to achieve net-zero CO₂ emissions across its domestic and international operations by 2050.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM