Delfin Midstream prepares for fall FID with key supplier deals in place

July 02, 2025

Agreements with Siemens, Samsung Heavy Industries, and Black & Veatch secure execution path for floating LNG project

Delfin Midstream has moved a step closer to reaching a final investment decision (FID) on its landmark floating LNG export project in the Gulf of Mexico, announcing new commercial agreements with Siemens Energy, Samsung Heavy Industries (SHI), and Black & Veatch. The deals, announced July 2, secure key turbine manufacturing capacity and advance detailed vessel engineering work as Delfin targets a positive FID this fall.

Houston-based Delfin said it has signed an agreement with Siemens Energy to reserve manufacturing slots for four SGT-750 gas turbine mechanical drive packages. These units will drive the mixed-refrigerant compressors central to Delfin’s offshore liquefaction process. The SGT-750 is a modular, mid-sized turbine designed for high efficiency and operation in demanding environments—an ideal fit, according to Siemens, for floating LNG (FLNG) operations.

“By making this large investment to lock in critical manufacturing capacity, we have secured our execution schedule,” said Delfin CEO Dudley Poston. “The anticipated delivery of our first FLNG vessel from Samsung Heavy Industries in 2029 remains on track.”

Siemens Energy Executive Board Member Karim Amin described the agreement as a milestone for U.S. LNG development. “We are excited to support Delfin’s energy infrastructure project,” he said, “providing the critical turbine drive packages needed as the company moves toward delivering the first offshore LNG project in the United States.”

In parallel, Delfin has entered into an Early Works program with SHI and Black & Veatch to advance the front-end engineering for the project’s first floating LNG vessel. The work will define detailed design specifications and prepare both contractors for the lump-sum, turnkey engineering, procurement, construction, and integration (EPCI) contract, expected to follow shortly after FID.

The Early Works effort is designed to de-risk project execution by ensuring all stakeholders are prepared to begin construction and integration immediately following a go-ahead decision.

First U.S. offshore LNG export license secured

Delfin’s progress follows the March 2025 issuance of the first-ever U.S. deepwater port license for LNG export. The license, awarded by the U.S. Maritime Administration (MARAD) to Delfin LNG LLC—a subsidiary of Delfin—authorizes the company to own and operate offshore LNG export infrastructure under the Deepwater Port Act of 1974. The decision aligns with the Trump administration’s energy export policy and builds on prior regulatory groundwork.

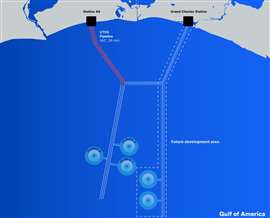

The approval gives Delfin a green light to proceed with a brownfield offshore development capable of deploying up to three FLNG vessels with a combined capacity of 13.2 million tonnes per annum (MTPA). By leveraging its existing deepwater port and the UTOS pipeline—the largest natural gas pipeline in the Gulf—Delfin aims to minimize onshore infrastructure requirements while delivering scalable export volumes to global markets.

Delfin’s floating LNG model represents a shift from traditional, land-based liquefaction projects. Floating liquefaction units (FLNGs) offer reduced capital intensity, shorter construction timelines, and greater deployment flexibility—all valuable attributes amid rising global gas demand and heightened scrutiny of energy project emissions.

With its Siemens gas turbines and modular design, the Delfin project is also expected to have a smaller carbon footprint than conventional LNG export terminals. Poston emphasized that the project could serve as both a long-term U.S. energy export platform and a regional economic driver.

“This is an incredibly exciting time for the development of Delfin’s critical energy infrastructure project,” he said.

Delfin has also secured U.S. Department of Energy approval for long-term LNG exports to countries that do not have free trade agreements with the United States, enhancing the commercial flexibility of its offtake strategy.

If the company reaches FID as planned in the fall, it would mark the next major step in a multiyear development process and potentially cement Delfin’s place as the operator of the first U.S. offshore LNG export terminal.

About Delfin Midstream

Delfin Midstream is an LNG infrastructure development company specializing in floating LNG solutions. Its lead project, Delfin LNG, is a brownfield deepwater port located off the coast of Louisiana, designed to accommodate multiple FLNG vessels. The project’s modular structure allows for phased deployment tied to commercial demand. Delfin also owns the UTOS natural gas pipeline system, providing direct connectivity between U.S. gas supplies and the offshore liquefaction site.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM