MHI Invests in electric hydrogen

June 24, 2022

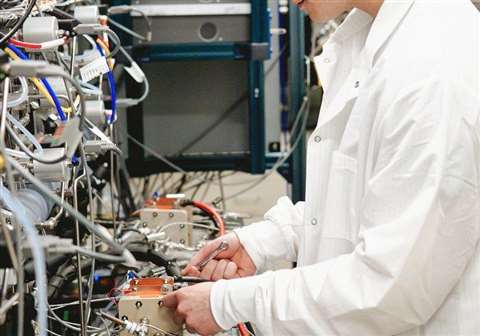

Electric Hydrogen design and builds electrolysis systems. (Photo: Electric Hydrogen.)

Electric Hydrogen design and builds electrolysis systems. (Photo: Electric Hydrogen.)

Mitsubishi Heavy Industries (MHI) has invested in Electric Hydrogen (EH2), a clean hydrogen startup headquartered in Natick, Massachusetts, to support its efforts in developing cost-competitive, fossil-free hydrogen. Terms of the investment were not announced.

Through this investment, MHI plans to strengthen and diversify its assets in the hydrogen value chain. The investment has been executed through Mitsubishi Heavy Industries America, Inc. (MHIA), which joins a consortium of investors including Breakthrough Energy Ventures, Equinor, Amazon, Honeywell, and Rio Tinto.

“No single company can provide needed technology to achieve global decarbonization, which is why we recognize the importance of investing in and enabling companies like Electric Hydrogen to develop new solutions,” said Takajiro Ishikawa, president and CEO of MHIA.

EH2’s patented approach to electrolysis – the process of producing hydrogen from electricity and water –is specially designed for the high-volume, low-cost production required to support massive industrial operations, which could significantly improve the levelized cost of hydrogen, the company said.

This investment will support the scale-up of EH2’s high electrolyzer technology and its use in the manufacturing, and deployment of pilot projects to produce fossil-free hydrogen, also known as “green hydrogen,” at large scale for industrial and infrastructure applications.

Industries not amenable to electrification, such as steel, fertilizer and intercontinental energy transport, account for more than a third of the world’s total greenhouse gas emissions, according to EH2. Hydrogen, when produced in places with abundant and clean electricity, is a promising pathway for decarbonizing these industries.

Electric Hydrogen (EH2) is a decarbonization company that produces low-cost, high-efficiency, fossil-free hydrogen systems. Its focus is on industrial applications of hydrogen in steel, ammonia and freight transport. Other strategic investors include Amazon Decarbonization Fund, Cosan, Equinor, Honeywell, Mitsubishi Heavy Industries and Rio Tinto.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM