Enerflex reports gains in revenue and operating earnings

November 11, 2022

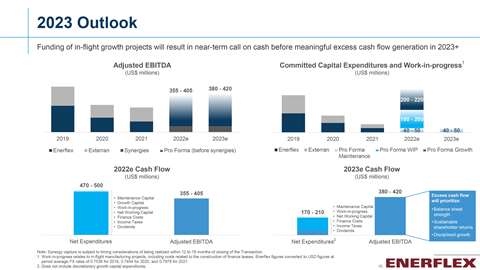

Enerflex reported its expected 2023 EBITDA would fall in the range of $380 - $420 million. (Graph: Enerflex Q3 investor presentation.)

Enerflex reported its expected 2023 EBITDA would fall in the range of $380 - $420 million. (Graph: Enerflex Q3 investor presentation.)

Calgary-based Enerflex reported significant gains in revenue, cash from operating activities and operating earnings in 3Q22, but had a net loss as a non-cash impairment weighed down results for the period.

Revenue for the quarter that ended Sept. 30 was nearly $393 million, up from $231 million a year earlier and the sixth consecutive quarter of increases. The company’s operating income was $23.6 million, up from $9.6 million a year ago. Despite those results, the company had a non-cash impairment charge of $48 million on previously recognized goodwill associated with its Canada segment, which led to a net loss of nearly $33 million for the period.

“The completion of the Exterran acquisition and strong global natural gas and energy transition market fundamentals, which has driven our combined backlog of $1.5 billion in modularized natural gas and carbon capture solutions, paves the way for the most exciting time in Enerflex’s forty-year history,” said Marc Rossiter, Enerflex’s president and chief executive officer.

“Our asset base of nearly two million horsepower of compression and over 25 gas plants worldwide provides cash flows that are low-risk, long-term, and diverse in geographies, counterparties, and commodity drivers. This stable portfolio of natural gas assets, the $1.5 billion backlog in Engineered Systems, and solid progress on three major Energy Infrastructure investments, will drive success on our three key value-creating priorities throughout 2023: strengthening our financial position; delivering on expected synergies; and growing our free cash flow, all in support of an attractive capital allocation framework,” he said.

The company closed the previously announced acquisition of Exterrran in October and said it is focused on integrating the two companies and delivering on expected annual run-rate synergies of approximately U.S. $60 million, which are expected to be captured within 12 to 18 months of the closing.

For the balance of 2022 and through 2023, Enerflex plans to complete three Energy Infrastructure investments and one cryogenic natural gas processing facility currently in progress in the Middle East. The first is a natural gas infrastructure asset that will be operational before year-end 2022, and is underpinned by a 10-year take-or-pay contract with a national oil company.

It will also complete a build-own-operate-maintain (“BOOM”) produced water facility that started operations in early November 2022, and is underpinned by a four-year take-or-pay contract with a national oil company. The facility is expected to be complete in the first half o 2023 and is supported by a 10-year take-or-pay contract with a joint venture between a national oil company and an international super-major oil and gas company.

The company plans to deliver a modularized cryogenic natural gas processing facility that is expected to be completed in 2023 and will be accounted for as a product sale.

Enerflex continues to expand its Energy Transition business, securing approximately $100 million of Energy Transition bookings during the third quarter of 2022. Once in operation, these carbon capture projects will collectively capture and permanently sequester over one million tonnes of carbon dioxide (“CO2”) per annum.

Enerflex entered into an agreement with a customer to provide a modularized integrated carbon capture facility that will abate approximately 450,000 tonnes of CO2 per annum.

The growing revenue stems from a large Engineered Systems opening backlog, a record-high utilization rate for the U.S.A. contract compression fleet, and favourable currency translation effects from a strengthening U.S. dollar, the company said.

The ongoing economic recovery has allowed the Company to capture higher-margin work. Enerflex’s third-quarter 2022 gross margin increased to $79 million, or 20.0%, from $64 million, or 17.1%, in the second quarter of 2022.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM