Enerflex to buy Exterran in $735 million transaction

January 24, 2022

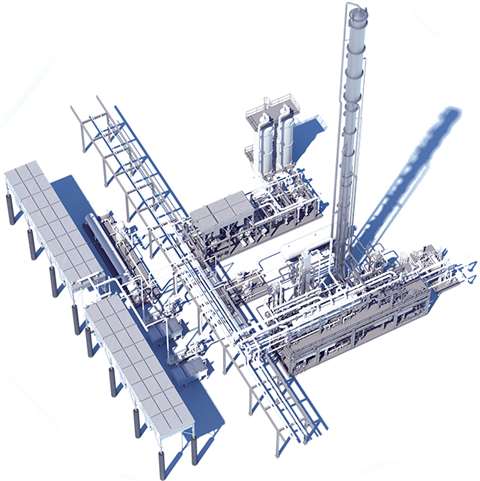

Enerflex provides cryogenic gas processing services.

Enerflex provides cryogenic gas processing services.

Two major natural gas processing companies will merge after Calgary-based Enerflex closes its $735 million acquisition of Exterran.

The all-stock transition will give Exterran shareholders 1.021 Enerflex common shares for each of their own shares, a combination which will result in a total of 124 million Enerflex common shares upon closing. The implied enterprise value of the combined companies is about $1.5 billion and the transaction value for Exterran is about $US375 million, Enerflex announced.

The transaction value for Exterran is approximately US$735 million, which represents an 18% premium to Exterran’s enterprise value as at January 21, 2022. Enerflex said the acquisition will allow it to provide better natural gas, water and energy transition clients and enhance shareholder value.

Upon closing, Enerflex shareholders will control 72.5% of the combined companies; Exterran shareholders will control the balance. Enerflex will continue to trade on the Toronto Stock Exchange and will apply for listing on either the New York Stock Exchange or the NASDAQ exchange.

“This is an exciting day in the history of our companies. The transaction is immediately accretive to shareholders; enhances our presence, offerings, and scale across our regions; and importantly, executes upon our years-long strategic goal of increasing recurring revenues to improve the profitability and resiliency of our platform,” said Marc Rossiter, Enerflex’s president and chief executive officer. “Enerflex and Exterran each have a long history of global expertise in the delivery of modular energy solutions. Together, we are more efficient and better positioned in global capital markets. The Transaction will improve our ability to partner with an expanded set of customers to solve their growing energy infrastructure challenges with integrity, creativity, commitment, and success.”

The transaction is expected to close in the second or third quarter of 2022, provided the shareholders of both companies and the Toronto Stock Exchange approve the transaction and pending other regulatory approvals.

“We are excited about the ability to create shareholder value through this transaction and improving our product and service offering. The scale and efficiencies this combination brings is the right path for Exterran and brings significant opportunities for accelerated growth in produced water treatment and energy transition products and services,” said Andrew Way, president and CEO of Exterran.

The combined market capitalization of the two companies is about $800 million and the combined enterprise value is around $1.5 million.

Upon closing, one Exterran director will be appointed to Enerflex’s board. Marc Rossiter will remain as Enerflex’s president and CEO and member of the Enerflex board. He will oversee all espects of integration. Sanjay Bishnoi will continue as Enerflex’s CFO and its executive management team will continue to serve in their current roles.

The boards of each companies have unanimously approved the transaction and recommended that their respective shareholders also approve it.

“The timing is right for this transaction as it strengthens our positioning while global energy markets recover from the pandemic-induced lows. Natural gas is a transition fuel that, together with renewables, will lead the world toward a lower carbon future. The world’s continued reliance on natural gas is evidenced by strong fourth quarter 2021 Engineered Systems bookings of over CAD$300 million, our highest bookings quarter since 2018,” said Rossiter. “This month, we also successfully commissioned a gas infrastructure facility in the Middle East that will further strengthen our asset ownership portfolio. The recovery remains widespread, and we are optimistic that overall market strength will continue in 2022.”

For its part, Exterran said it expected fourth quarter results to be in line with the guidance provided in its third quarter call.

“Net debt and cash flow for the fourth quarter were favorable to our forecast, putting us in a good position as we enter the new year. The macro environment continues to be supportive of strong bookings in the first half of 2022,” said Way. “We continue to execute well on our two water ECO projects along with the large processing facility in the Middle East, all of which are expected to commence operations on time.”

Enerflex provides natural gas compression, oil and gas processing and refrigeration systems. It is based in Calgary and trades on the Toronto Stock Exchange under the symbol EFX. It has 2000 employees worldwide. Houston-based Exterran Corporation provides natural gas processing and treatment products and services. It trades on the New York Stock Exchange and has operations in 25 countries.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM