Read this article in 中文 Français Deutsch Italiano Português Español

Another major merger announced

October 24, 2023

Chevron announces $53 billion deal

A Hess Corp. well site in the Bakken formation. Chevron announced an all-stock deal to buy Hess Corp. for $53 billion, (Image: Hess Corp.)

A Hess Corp. well site in the Bakken formation. Chevron announced an all-stock deal to buy Hess Corp. for $53 billion, (Image: Hess Corp.)

Chevron said it will acquire oil and gas company Hess Corp. for $53 billion, the second major consolidation announced in October.

The all-stock deal would give Chevron Hess global operations including the Stabroek block in Guyana as well as Bakken assets.

“This combination positions Chevron to strengthen our long-term performance and further enhance our advantaged portfolio by adding world-class assets,” said Chevron Chairman and CEO Mike Wirth. “Importantly, our two companies have similar values and cultures, with a focus on operating safely and with integrity, attracting and developing the best people, making positive contributions to our communities and delivering higher returns and lower carbon.”

The announcement comes after Exxon announced Oct. 11 that it would buy Pioneer Natural Resources in a deal worth about $65 billion.

Hess assets include:

Guyana – 30% ownership in more than 11 billion barrels of oil equivalent discovered recoverable resource with high cash margins per barrel, strong production growth outlook and potential exploration upside.

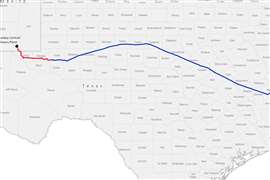

Bakken – 465,000 net acres of high-quality, long-duration inventory supported by the integrated assets of Hess Midstream.

Complementary Gulf of Mexico assets and steady free cash flow from Southeast Asia natural gas business.

With a stronger portfolio after closing, Chevron expects to increase asset sales and generate $10 to $15 billion in before-tax proceeds through 2028.

The transaction is expected to achieve run-rate cost synergies around $1 billion before tax within a year of closing.

The acquisition consideration is structured with 100 percent stock utilizing Chevron’s equity. In aggregate, upon closing of the transaction, Chevron will issue approximately 317 million shares of common stock. Total enterprise value of $60 billion includes net debt and book value of non-controlling interest.

The transaction has been unanimously approved by the Boards of Directors of both companies and is expected to close in the first half of 2024. The acquisition is subject to Hess shareholder approval. It is also subject to regulatory approvals and other customary closing conditions.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM