Natural gas rigs in the Appalachian Basin fell in 2H 2021

February 08, 2022

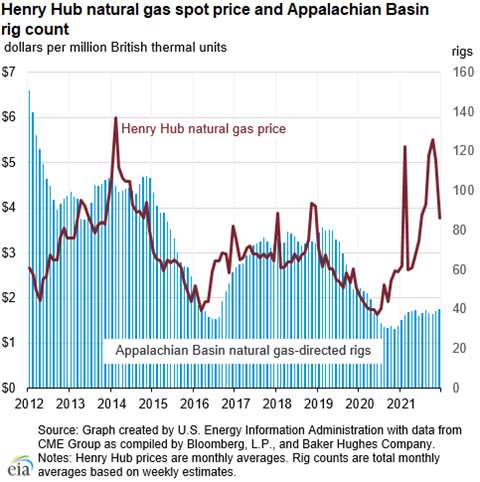

The number of natural gas rigs operating in the Appalachian Basin fell in the second half of 2021 despite the increase in natural gas prices in the same period, a recent study from the U.S. Energy Information shows.

This decline in drilling activity runs counter to the usual trend in the gas industry. Typically producers increase drilling activities as gas prices rise, although usually with a lag of about four months.

Over a period of seven months in 2021, the benchmark Henry Hub price more than doubled from a monthly averaged of $2.62/MMBtu in March to $5.51/MMBtu in October. The number of operating rigs in the Appalachian Basin fell from 39 to 37 in the same period. Since then, the number has risen to an average of 40 rigs in December and 42 in January, the EIA reported.

Producers in the Appalachian Basin have several reasons to not add rigs to their drilling fleets in the fourth quarter of 2021. For one, pipeline takeaway capacity out of the area remains constrained, which limits the amount of gas that can be removed from the region.

Pipeline takeaway capacity from the region has grown dramatically in recent years, although not enough to keep up with the growth in production. From 2008 through 2020, total takeaway capacity increased from 4.5 Bcf/d to 24.5 Bcf/d. Most of that growth occurred between 2014 and 2020, when pipeline capacity increased by 16.5 Bcf/d.

The FM100 Project and the Leidy South Project, which were completed in December, added 910 MMcf/d of takeaway capacity. Total pipeline takeaway capacity from the region averages around 36 Bcf/d, according to estimates from IHS Markit.

Initial well production from the Appalachian Basin has surged in the past four years, from about 17 MMcf/d for new wells between 2017 and 2019 to an average of 29 MMcf/d in 2021. The increase comes largely from an increase in well productivity, which allow producers to maintain production without drilling as many new wells.

A second cause in the growing production from the region is the drawdown in drilled but uncompleted wells (DUC.) Data from IHS Markit shows that production averaged 34.8 Bcf/d in the second half of 2021, the highest average for a six-month period since production began in 2008, the EIA reported.

Another reason for the decline in new rigs in the region is financial. Producers who hedged their 2021 production at lower natural gas prices were unable to benefit from higher prices in the second half of the year. Future prices at the time also indicated that the higher prices might not hold, which reduced incentives to increase the number of new rigs in the region.

Two of the top five producers in the Appalachian Basin revised down their guidance on capital spending for 2021, and at least two others held capital spending unchanged, choosing instead to use higher free cash flow to draw down debt, increase dividends, and improve cash balances, the EIA reported.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM