Read this article in 中文 Français Deutsch Italiano Português Español

XRG completes acquisition of stake in Rio Grande

September 30, 2025

Company marks first U.S. gas infrastructure investment with Brownsville facility

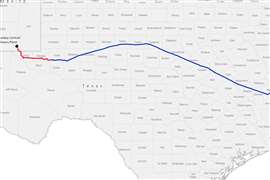

XRG P.J.S.C. has closed its acquisition of an 11.7% equity stake in Phase 1 of the Rio Grande LNG project in Brownsville, Texas. The investment, covering Trains 1–3, is part of a joint venture between XRG and Global Infrastructure Partners (GIP), a BlackRock company.

Rio Grande LNG is one of the largest liquefied natural gas export projects under development in the United States. When fully built, the facility could have capacity of about 48 million tons per annum (mtpa). Construction of the first three trains is underway, while a final investment decision for Train 4 was reached in early September.

Mohamed Al Aryani, president of XRG International Gas, said the investment aligns with the company’s plan to expand its global gas and LNG business.

“As LNG demand is projected to grow by 60% by 2050, the investment in Rio Grande LNG advances XRG’s strategy to build a leading global gas and LNG business to meet structural demand from industry, AI, and broader economic growth,” he said.

Al Aryani added that XRG’s international gas portfolio now spans the Caspian region, Africa and the Americas, reflecting the company’s long-term investment approach.

Left to right: Adebayo Ogunlesi, Dr. Sultan Al Jaber, Larry Fink, Mohamed Al Aryani.

Left to right: Adebayo Ogunlesi, Dr. Sultan Al Jaber, Larry Fink, Mohamed Al Aryani.

The Rio Grande project is expected to employ more than 5,000 construction and trade workers at peak and create 350–400 long-term operational roles once in service.

The transaction, first announced in May 2024, marks XRG’s entry into U.S. gas infrastructure. It was executed through an investment vehicle of GIP, with XRG acquiring a portion of GIP’s existing stake.

In a related step, XRG’s parent company ADNOC signed a 20-year LNG offtake agreement for 1.9 mtpa from Rio Grande Train 4, reinforcing the connection between the equity investment and future supply.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM