U.S. natural gas prices expected to climb in 2021

22 June 2021

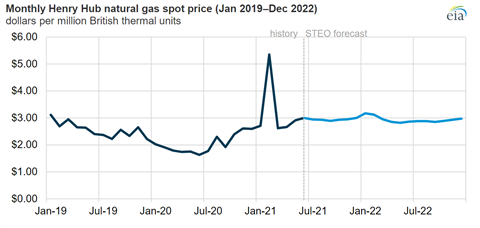

Forecasted spot prices for natural gas in 2021.

Forecasted spot prices for natural gas in 2021.

U.S. natural gas prices are expected to surge in 2021 as an increase in exports and a growth domestic consumption outside the power sector outpace the expected growth in domestic production, according to the most recent forecast from the U.S. Energy Information Administration.

The average 2021 spot price at Henry Hub will average $3.07/MMBtu, an increase of $1.04/MMBtu from 2020, a year of record lows. For 3Q2021, the EIA forecast an average spot price of $2.92/MMBtu.

A hard freeze in many parts of the U.S. in February forced an abrupt increase in spot prices as demand for heating surged at the same time that some production was shut in. In February, the spot price at Henry Hub averaged $5.35/MMBtu, or $3.44/MMBtu higher than February 2020. Although the spot price did not remain at those levels, the record prices in February has influenced the annual 2021 average.

Although prices have eased since then, they remain elevated well above the record lows seen in 2020 and are expected to remain elevated for the rest of the year, the EIA forecast. Strong U.S. natural gas exports and consumption from all other gas consumption sectors outside of electricity generation have driven up spot prices, a market trend the EIA expects will hold for the rest of the year.

The U.S. is expected to export 3.8 Bcf/d more gas in 2021 than in 2020. Total exports, both by pipeline and LNG are expected to average 18.3 Bcf/d in 2021, and 18.4 Bcf/d in 2022, both of which exceed the record of 14.4 Bcf/d in 2020.

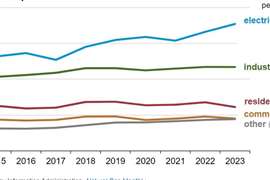

These increases in demand are slightly offset by a decrease in natural gas consumption in the electric power sector caused by the increase in higher natural gas prices. The EIA said it expects natural gas consumed in the electric power sector to average 29.4 Bcf/d in 2021 and 29.3 Bcf/d in 2022, both down from 31.7 Bcf/d in 2020.

Looking forward to 2022, the EIA said it expected the Henry Hub average spot price to decrease to $2.93/MMBtu in 2022 from the 2021 average. In 2022, U.S. supply is expected to grow by 0.66 Bcf/d, but non-power sector demand grows by 0.31 Bcf/d—a slower rate than supply growth.

In 2022, a 1.8 Bcf/d rise in U.S. natural gas production drives the forecast growth in natural gas supply, which is slightly offset by a decline in U.S. imports of natural gas. U.S. natural gas supply will likely outpace U.S. demand in 2022, which supports the EIA’s forecasted price decline from 2021 to 2022.

In May, the natural gas spot price at Henry Hub averaged $2.91/MMBtu, up from the April average of $2.66/MMBtu. The EIA said it expected U.S. consumption to average 89.2 Bcf/d in 2021, down 0.5% from 2020. Overall demand is expected to fall in part because electric power generators are expected to switch to coal from natural gas in 2021. Residential and commercial gas consumption combined will rise by 1.2 Bcf/d from 2020 and industrial consumption will rise by 0.7 Bcf/d from 2020. Looking forward to 2022, the EIA forecast domestic consumption will average 82.8 Bcf/d.

Natural gas inventories ended May 2021 at almost 2.4 Tcf, 3% down from the five-year average for that point in the year. More gas was drawn from storage in the winter of 2020-2021 than the average for the previous five winters. Inventories will end the 2021 injection season, usually around the end of October, at 3.6 Tcf, a level that would be 4% below the five-year average.

Overall production of dry gas rose by 6.0 Bcf/d in March to 92.3 Bcf/d. Dry gas production is expected to reach 92.9 Bcf/d in 2H21 and rise further to 93.9 Bcf/d in 2022, according to the EIA forecast.