U.S. natural gas price forecasts decline

November 08, 2022

The U.S. Energy Information Administration has lowered its forecast for natural gas spot prices in response to slower overall expected economic growth and better than expected inventories for the winter.

The average spot price for natural gas at Henry Hub is expected to reach $6.49/MMBtu for all of 2022, down from a previous forecast of $6.88/MMBtu. For 2023, the EIA has forecast spot prices of $5.46/MMBtu, down from a previous forecast of $5.77/MMBtu.

The agency’s latest Short Term Energy Outlook lowered the forecast for natural gas prices after the S&P Global macroeconomic model has predicted that U.S. GDP will fall 0.1% in 2023, which will contribute to a decline in total energy consumption next year.

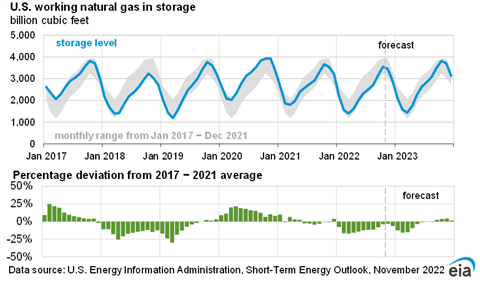

The EIA estimated U.S. natural gas inventories ended October at more than 3.5 trillion cubic feet (Tcf), which is 4% below the five-year average, but higher than the agency had previously forecast.

The EIA saw stronger than average injections of ntural gas into storage in September and October, which contributed to a decline in gas prices in those months. The natural gas spot price at Henry Hub averaged $8.80 per million British thermal units (MMBtu) in August but declined to an average of $5.66/MMBtu in October.

Because the U.S. is headed into winter with inventory levels higher than previously expected, the EIA has lowered its forecast natural gas prices for the winter. The most recent forecast calls for natural gas spot prices to average around $6/MMBtu in 4Q22 and 1Q23, a level that is more than $1/MMBtu lower than the agency forecast in its previous outlook.

“We expect natural gas prices will decline after January as the deficit to the five-year average in inventories decreases,” the agency wrote.

The EIA has forecast that consumption will draw down inventories over the winter by 2.1 Tcf to 1.4 Tcf by the end of March 2023. That level would be about 8% below fore the five-year average for that time of year.

Natural gas inventories play an important role in price formation. Inventory levels below the five-year average are often correlated with higher natural gas prices, while inventory levels above the five-year average are often correlated with lower natural gas prices, the EIA said.

U.S natural gas production has increased steadily throughout 2022 and dry natural gas production will average around 100.4 Bcf/d in November, the agency predicted.

“We expect declines in natural gas production during the winter months due to the possibility of extreme weather, which can cause production shut-ins,” the agency wrote.

“We expect that lower prices and some constraints in the pipeline capacity to move natural gas from production fields to consuming markets will reduce drilling activity, and we forecast natural gas production will average 99.7 Bcf/d in 2023, 2% more than in 2022, but down from current monthly average production.”

Natural gas prices generally climb in the winter as colder weather increases demand for natural gas for space-heating. Based on the current weather forecast from the National Oceanic and Atmospheric Administration, the EIA forecast assumes colder weather, with 2% more heating degree days (HDD) from November to March compared with the 10-year (2011–2021) average.

The EIA forecast that drawdowns on natural gas stocks in December and January will outpace the five-year average, caused by a seasonal decline in natural gas production, rising demand for space heating and increases in demand for heating and LNG exports.

LNG exports, meanwhile, are expected to rise again after the Freeport LNG plant returns to production starting in November. That plant had a fire earlier this summer, which halted operations and lowered LNG production from the U.S.

Although the EIA has predicted lower average prices for natural gas, it stressed the potential for temporary and regional price spikes this winter in response to abrupt changes in weather, surges in demand and local production issues not currently foreseen.

“Price spikes could affect both Henry Hub and regional pricing hubs, particularly in New England. Price spikes will have a limited effect on retail natural gas prices this winter, as there is typically a delay between changes in wholesale and retail prices for natural gas,” the agency wrote.

We expect downward pressures on natural gas prices will emerge in 2Q23. In 2023, the combination of natural gas consumption and exports in our forecast falls by more than 1 Bcf/d on average compared with 2022, while combined production and imports rise by a similar amount, leading to strong injections during the 2023 refill season.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM