Read this article in 中文 Français Deutsch Italiano Português Español

Russia’s natural gas, coal exports have been decreasing and shifting toward Asia

September 03, 2025

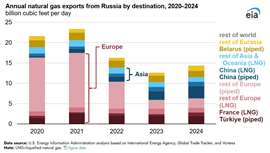

Russia’s energy export mix has undergone a major restructuring since its full-scale invasion of Ukraine in February 2022, with natural gas and coal shipments to Europe falling sharply and new trade flows developing in Asia, according to a report from the U.S. Energy Information Administration (EIA).

While Moscow has successfully redirected crude oil exports eastward with minimal infrastructure changes, natural gas and coal have proven more difficult to reroute due to capacity limits in pipelines and railways.

Natural gas exports to Europe, once the cornerstone of Russia’s energy trade, have dropped by more than two-thirds. EU imports fell from 14.7 billion cubic feet per day (Bcf/d) in 2020 to just 4.4 Bcf/d in 2024. Although the EU has not directly sanctioned Russian gas, a combination of sanctions, diversification policies and market adjustments has cut reliance on Moscow’s supplies. To offset these losses, Russia has looked east. The Power of Siberia 1 pipeline, completed in 2019, has become the primary conduit for shipments to China. Since the Chinese portion was finished in December 2024, flows have run near the system’s 3.7 Bcf/d design capacity. A second line, the proposed Power of Siberia 2, could connect western Siberian reserves to eastern China, but the project would require more than 2,000 miles of new pipeline. Despite years of negotiations, Beijing and Moscow have yet to finalize terms.

Coal exports have faced similar constraints. European sanctions on Russian coal took full effect in August 2022, cutting off markets that once received nearly one-third of Russia’s supply. In 2020, Germany, Türkiye and the Netherlands were among the largest European buyers. By 2024, Europe accounted for just 13% of Russian coal exports, most of it going to Türkiye, which is not an EU member. The United States, meanwhile, increased coal shipments to fill the gap in Europe.

Asia has emerged as Russia’s primary outlet for coal. China has been the dominant buyer since 2020 and in 2024 took slightly more than half of Russia’s coal exports. India has also become a fast-growing customer, raising imports from 9.1 million short tons (MMst) in 2020 to nearly 24.8 MMst in 2024, largely to meet rising electricity demand. South Korea has increased purchases as well.

Despite these shifts, total Russian coal exports remain below pre-war levels. Volumes fell 9% between 2020 and 2022, followed by another 13% decline through 2024. Russia primarily relies on rail to move coal, and the loss of European markets has put pressure on its limited eastbound rail infrastructure. Congestion and delays have hindered deliveries to Asia, underscoring the country’s transportation bottlenecks.

Together, the trends highlight the uneven success of Russia’s pivot to Asia. While crude oil has been redirected with relative ease, the lack of sufficient infrastructure continues to limit the flow of natural gas and coal. Without major investments in pipelines and railways, Russia’s ability to replace lost European energy markets will remain constrained.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM