Number of U.S. gas rigs drops sharply in 2023

October 25, 2023

Decline in active drilling coincides with lower natural gas price

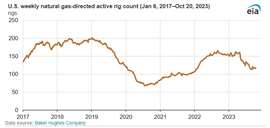

The number of natural gas rigs operating in the U.S. has dropped 24% since the beginning of 2023, according to numbers cited by the U.S. Energy Information Administration (EIA).

The EIA said Baker Hughes reported 118 natural gas-directed rigs were active in the U.S. on Oct. 20, a decrease of 38 rigs since the start of 2023. The decline in active drilling rigs coincides with lower natural gas prices for most of 2023, compared with relatively high natural gas prices for most of 2022.

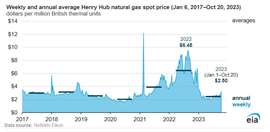

Producers may not respond immediately to decreases in natural gas prices; it typically takes four to six months for producers to respond to price changes. The extent to which producers respond to price changes is based on several factors, such as uncertainty around future prices, volatility in the market, price hedging, and current costs of materials, equipment, and labor.

In 2022, the natural gas spot price at the U.S. benchmark Henry Hub averaged $6.45 per million British thermal units (MMBtu). Although the Henry Hub price began to decline after peaking in August 2022, it remained relatively high until the end of the year, averaging above $6.00/MMBtu. The Henry Hub price fell below $4.00/MMBtu in January 2023 and continued declining throughout 2023, averaging $2.50/MMBtu from January through Oct. 20, almost $4.00/MMBtu less than the average last year.

A few months after the decline in natural gas prices in January, the number of active U.S. natural gas-directed rigs began to decline, the EIA said. The number of active U.S. natural gas-directed rigs fluctuated between 150 rigs and 162 rigs for the first four months of 2023 and then began to decline in May, falling as low as 113 rigs on Sept. 8.

In the Permian region, which accounted for 18% of all U.S. natural gas production in 2022, most natural gas production is associated with crude oil production, meaning most rigs operating in the Permian region are oil-directed, not natural gas-directed. As a result, producers in the Permian region typically respond to changes in the crude oil price when planning their exploration and production activities. The oil-directed rig count in the Permian region followed a similar pattern to the U.S. natural gas-directed rig count, dropping from 357 rigs in May to 305 rigs on Oct. 20. Similar to the Henry Hub price, the West Texas Intermediate crude oil price began to decline in August 2022, but it remained elevated until December 2022 when the price dropped below $80.00 per barrel.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM