New wave of offshore developments set to boost Gulf

June 06, 2025

But natural gas output expected to dip slightly despite new field activity

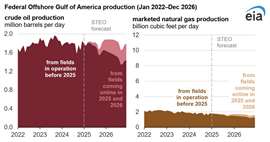

Crude oil production in the U.S. Federal Offshore Gulf of Mexico is forecast to rise slightly over the next two years, supported by the start-up of more than a dozen new fields, according to the U.S. Energy Information Administration’s (EIA) latest Short-Term Energy Outlook.

The EIA expects Gulf of Mexico (GOM) oil output to average 1.80 million barrels per day (b/d) in 2025 and 1.81 million b/d in 2026, compared with 1.77 million b/d this year. Natural gas production, by contrast, is forecast to decline from 1.79 billion cubic feet per day (Bcf/d) in 2024 to 1.72 Bcf/d in 2025 and 1.64 Bcf/d in 2026.

Despite the modest growth in oil production, the EIA noted that without new projects, output from the Gulf would decline. The Gulf is expected to contribute roughly 13% of total U.S. crude oil production and about 1% of marketed natural gas production in 2025 and 2026.

13 new fields on the horizon

Operators are expected to bring 13 new oil and gas fields online between 2025 and 2026, including both subsea tiebacks and new floating production units (FPUs). Eight of the fields will be connected to existing infrastructure via underwater extensions, while five will produce through four newly built FPUs.

The EIA estimates these new fields will contribute 85,000 b/d of crude oil in 2025 and 308,000 b/d in 2026. Associated natural gas output from the same fields is forecast at 0.09 Bcf/d in 2025 and 0.27 Bcf/d in 2026.

Major projects already underway

Three fields began producing earlier this year:

- Whale: One of the most significant new projects, the Whale field started producing in January 2025 from a new namesake FPU in over 8,600 feet of water. It is expected to reach a peak production of 85,000 b/d.

- Ballymore: Came online in April 2025 as a subsea tieback to the Blind Faith facility. It is projected to produce up to 75,000 b/d from wells targeting the emerging Upper Jurassic/Norphlet play.

- Dover: Also launched in April, Dover is tied back to the Appomattox facility and is forecast to produce around 15,000 b/d at its peak.

Several projects are expected to commence production in the second half of 2025:

Shenandoah: A high-pressure, deepwater development, Shenandoah will begin producing from its own FPU in June 2025 with an initial output of 120,000 b/d, ramping up to 140,000 b/d in 2026.

Leon and Castile: These fields will be developed through the refurbished Salamanca FPU, which will process up to 60,000 b/d of oil and 40 million cubic feet per day of natural gas.

Additional subsea tiebacks slated to begin late in the year include Katmai West, Sunspear, Argos Southwest Extension, and Zephyrus Phase 1.

Looking ahead to 2026, three more subsea tiebacks are scheduled to start up:

- Silvertip Phase 3

- Longclaw

- Monument, which will tie back to the Shenandoah FPU

Hurricane season poses risk

The EIA cautioned that the development and production timelines for these new projects could be delayed by hurricanes. Colorado State University predicts the 2025 Atlantic hurricane season will be above average, with 17 named storms expected to form—raising the potential for weather-related disruptions in the Gulf of Mexico.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM