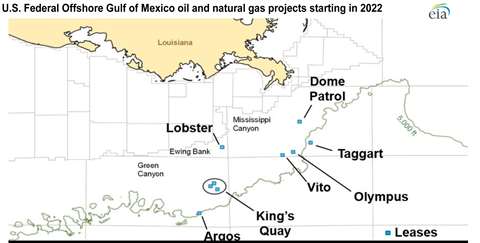

Nine new Gulf of Mexico fields to start in 2022

June 21, 2022

Nine new oil and gas fields in the U.S. Gulf of Mexico are expected to start production this year and will enable the region to account for 5% of all U.S. gas production and 14% of all oil production, according to a recent forecast.

Despite the expected production from the new fields, the total output of gas and oil from the region is not expected to change significantly because the new production does not quite offset the declining production from existing fields, the U.S. Energy Information Administration reported in its latest Short-Term Energy Outlook.

The new oil and gas production will come online gradually but by the end of 2023, gas production will average 2.1 Bcf/d, down 0.1 Bcf/d expected this year. The gas produced from the region should decline for the third year, according to the EIA forecast. Oil production is expected to hold essentially unchanged at 1.8 million b/d by the end of 2023.

In 2021, the Gulf of Mexico accounted for 15% of all U.S. oil production and 2% of the country’s gas production. Eight of the nine new fields will produce both oil and gas, while the ninth field will produce only oil, the EIA forecast. The additional capacity will not quite sustain oil production at levels similar to the end of 2021

Since the late 1990s, oil and gas companies in the region have targeted oil-bearing reservoirs. Today, most of the natural gas produced in the GOM comes from associated-dissolved natural gas production in oil fields instead of natural gas fields.

In 2020, gross withdrawals of natural gas in the GOM that came from natural gas wells accounted for less than 30% of total GOM natural gas production, compared with 76% in 1999.

“We expect the large development fields of Argos (BP), King’s Quay (Murphy Oil Corp.), and Vito (Shell) to begin production in 2022,” the EIA reported. “Each has a peak production capacity of 100,000 barrels of oil equivalent per day (MBOE/d) or more, and each is the result of a focused effort to lower the costs of field developments.”

Offshore producers have simplified and standardized floating production systems and collaborated with overseas construction services companies to reduce total costs and remain competitive with onshore producers.

However, fields expected to start in 2022 may shift into the following year if their start-up dates are pushed back. In addition, fields expected to start in 2024 could begin earlier, resulting in changes to the agency’s initial production forecasts.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM