Natural gas prices plunge in first half of year

July 24, 2023

EIA: Henry Hub price down 34%

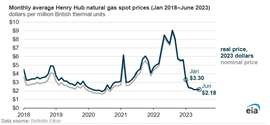

The average monthly spot natural gas price at the U.S. benchmark Henry Hub fell 34% between January and June, the U.S. Energy Information Administration (EIA) reports.

According to data from Refinitiv Eikon, the Henry Hub price averaged $3.30/MMBtu in January on an inflation-adjusted basis and then dropped below $2.50/MMBtu starting in February. Relatively mild temperatures, record production, and higher-than-average inventories reduced natural gas prices. When adjusted for inflation, this year has seen the lowest average monthly Henry Hub price since June 2020, the EIA said in a news release.

“Relatively mild winter temperatures reduced demand for space heating across most of the United States in the first quarter of 2023, reducing natural gas consumption,” The EIA stated. “The West Census Region was the only part of the Lower 48 states to experience relatively colder winter temperatures this winter than last winter.”

But the EIA expects prices to rebound as the year continues.

“We forecast Henry Hub prices will increase from the current price between July and December 2023, averaging $2.83/MMBtu through the end of 2023, according to our July Short-Term Energy Outlook,” The EIA stated. “We expect the price to peak at $3.44/MMBtu in December, up from $2.18/MMBtu in June. We expect consumption will rise to 107 Bcf/d in December 2023, a 2.1 Bcf/d decrease from December 2022. We expect dry natural gas production to average 102.6 Bcf/d (from July to December).”

U.S. natural gas consumption averaged 103.0 billion cubic feet per day (Bcf/d) between January 1 and April 30, 2023, down 1.0 Bcf/d from the same period in 2022, according to the EIA’s Natural Gas Monthly. The decline was led by the residential and commercial sectors, where combined consumption fell 18% in January and 12% in February 2023 compared with the same months in 2022. Industrial natural gas consumption also decreased slightly, falling 3% in the first quarter of 2023 compared with the first quarter of 2022. However, the electric power sector, which consumes more natural gas than any other sector, used a record-high average of 30.78 Bcf/d between January and March 2023, up 8.4% compared with the same period in 2022. This increase was driven by the increased winter heating demand in the West.

U.S. dry natural gas production has outpaced demand so far in 2023, contributing to lower natural gas prices. Dry natural gas production has remained at record highs in 2023, averaging over 101.0 Bcf/d each month. In the first quarter of 2023, dry natural gas production increased 7%, or 6.9 Bcf/d, from the same period in 2022.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM