Read this article in 中文 Français Deutsch Italiano Português Español

Infinity expands Utica footprint

December 08, 2025

Deal adds core acreage, long-lateral drilling runway and strategic gathering infrastructure across eastern Ohio

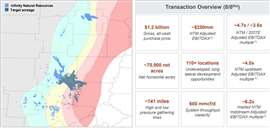

Infinity Natural Resources is making its largest move yet in the Appalachian Basin, agreeing to acquire a broad package of upstream and midstream assets in eastern Ohio from Antero Resources and Antero Midstream. The assets, which span Guernsey, Belmont and Harrison counties, significantly expand Infinity’s Utica Shale position and give the operator greater control over development planning, gathering and water handling.

Northern Oil and Gas will take a 49 percent undivided interest in the acquired properties, entering the venture as a nonoperating partner, while Infinity will hold 51 percent and remain operator.

The transaction extends Infinity’s contiguous acreage position to roughly 102,000 net acres and adds an estimated 110 undeveloped drilling locations across volatile-oil, rich-gas and dry-gas windows. Those locations total more than 1.6 million feet of potential lateral length, giving the company diverse options for capital allocation and long-term development pacing.

Infinity said the asset package fits its operating model of consolidating high-quality positions in the core of the play. “We are acquiring high-quality, cash-generating assets in the heart of the Utica Shale that immediately compete for capital and significantly enhance our operational scale,” said Zack Arnold, Infinity’s president and CEO. He said the acreage and infrastructure align closely with the company’s existing Ohio footprint, allowing for coordinated planning and shared facilities.

The acquired properties include approximately 255 producing laterals, most of which are operated, with third-quarter 2025 production averaging about 133 MMcfe per day. Infinity noted that the producing wells have relatively low decline rates, which it expects to help support a steady production base while the company brings new wells online.

A major component of the deal is the midstream system tied to the acreage. That system includes roughly 141 miles of gathering lines with capacity of about 600 MMcf per day and 90 miles of water lines. Infinity said the gathering network will allow it to capture operational efficiencies, reduce dependence on third parties and exert more control over gas flow, takeaway options and field-level costs. A marketing contract associated with the assets provides additional flexibility around pricing and transportation.

The company expects to run two operated rigs after closing, increasing development activity across its expanded footprint. Executives said the contiguous acreage block enables longer laterals and optimized spacing — two drivers of improved well economics in recent years across the Utica. Infinity also highlighted expected synergies in completion design, water logistics and pad utilization.

With the new assets, Infinity is positioned to grow production in 2026 and 2027 while continuing to focus on low-breakeven locations. Company officials said the added inventory enhances the long-term development runway and creates opportunities under a range of commodity-price environments.

The boards of Infinity, Northern, Antero Resources and Antero Midstream have approved the transaction, which has an effective date of July 1, 2025 and is expected to close in the first quarter of 2026, subject to customary conditions.

Infinity, headquartered in Morgantown, W.Va., operates across the Utica in eastern Ohio and the Marcellus and Utica dry-gas plays in southwestern Pennsylvania. The company said the new integrated position is expected to strengthen its standing among Appalachian gas producers and support continued operational efficiency gains.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM