EQT buying major transmission company

March 11, 2024

Deal worth $35 billion

EQT Corp. is acquiring Equitrans Midstream for $35 billion in a deal the company said will create America’s only large-scale, virtually integrated natural gas company.

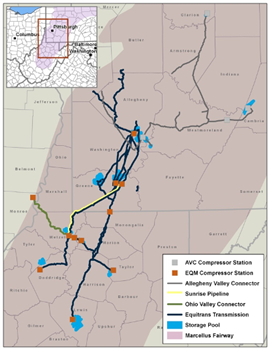

Equitrans has an asset footprint in the Appalachian Basin and, as the parent company of EQM Midstream Partners, is one of the largest natural gas gatherers in the United States. Through its strategically located infrastructure assets in the Marcellus and Utica regions, Equitrans has an operational focus on gas transmission and storage systems, gas gathering systems, and water services that support natural gas development and production across the Basin.

“Equitrans is the most strategic and transformational transaction EQT has ever pursued, and we see this as a once in a lifetime opportunity to vertically integrate one of the highest quality natural gas resource bases anywhere in the world,” said EQT President and CEO Toby Z. Rice. “As we enter the global era of natural gas, it is imperative for U.S. natural gas companies to evolve their business models to compete on the global stage against vertically integrated rivals. We have identified multiple, high confidence near-term synergies, with significant upside from future infrastructure optimization projects that we believe will drive material value creation for shareholders over time. Our modern, data-driven operating model, first-hand knowledge of Equitrans’ operations and successful track record integrating $9 billion of acquisitions, all of which included midstream assets, gives me tremendous confidence in EQT’s ability to seamlessly combine the two companies and capture synergies.”

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM