China to become world’s largest LNG market in 2021

June 23, 2021

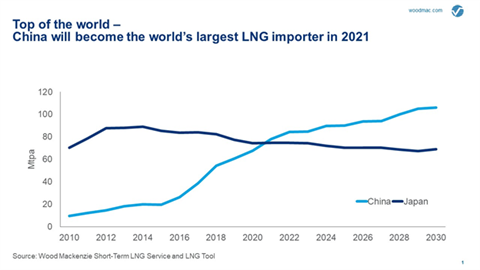

Wood Mackenzie report expects China to surpass Japan as world’s largest LNG market.

Wood Mackenzie report expects China to surpass Japan as world’s largest LNG market.

Fueled by a steady demand for electricity, China will become the world’s largest LNG market in 2021, according to a recent report published by Wood Mackenzie.

Utilities and trading houses in Japan have signed a series of long-term supply contracts that previously made Japan the world’s largest market. But demand in that country is in a long-term structural decline, creating an opportunity for China to surpass Japan as the world’s largest LNG market, Wood Mackenzie reported.

Last year was an anomaly for the growth in Asian LNG demand, but for the first five months of 2021, China has been the largest contributor to a resurgence in demand. Demand in China is expected to grow 11 million tonnes more than last year, more than half of the 18 million tonnes in additional global demand.

“With its LNG demand bolstered by clear policy support and strong gas market fundamentals, China’s top spot looks assured for years to come,” the report stated. The strength of the demand for LNG in China has taken the industry by surprise. A large part of the resiliency in the demand for LNG in Asia stems from China’s economic performance. Its Q1 2021 GDP grew 18% from the same quarter one year earlier, Wood Mackenzie reported.

China’s imports of LNG rose 30% from last year and show no signs of slowing. The strong demand stems from three sectors: space heating, industrial gas demand and power producers. Rising electricity consumption, driven by China’s economic recovery, accounts for a large portion of the growth in imports.

The demand for electricity has led gas-fired power generation to jump 14% in the first four months of the year compared with the same period a year ago. The surge in demand for electricity has come at the same time that lower rainfall has led to lower hydrogeneration in southwest China, Wood Mackenzie reported.

To keep up with the growing demand for electricity, power plants have purchased more gas, even as Asian LNG spot prices have climbed above US$10/MMBtu. In response, users have attempted to shift to lower-cost pipeline gas in available areas. But pipeline gas is constrained and power producers are under pressure to ensure adequate electricity supply.

Australia remains China’s largest LNG supplier despite a decline in volume in April that led to a small decrease in Australia’s market share to 43%, from 45% of LNG imports previously, Wood Mackenzie reported. The U.S., meanwhile, expanded its market share in China to 8% of LNG imports as more gas flowed into terminals held by CNOOC and Sinopec.

China is expected to increase gas supplies from all sources, and Wood Mackenzie expects buyers to remain busy in the spot market and that China’s oil companies will continue to import LNG from Australia.

Gas imported by pipeline from Russia remains China’s lowest cost option, but that alternative is not enough to meet the expected demand and China will continue to need additional LNG imports to keep up with that growth in demand, Wood Mackenzie reported.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM