Gas Rig Count Lowest Since ’16: EIA

May 01, 2020

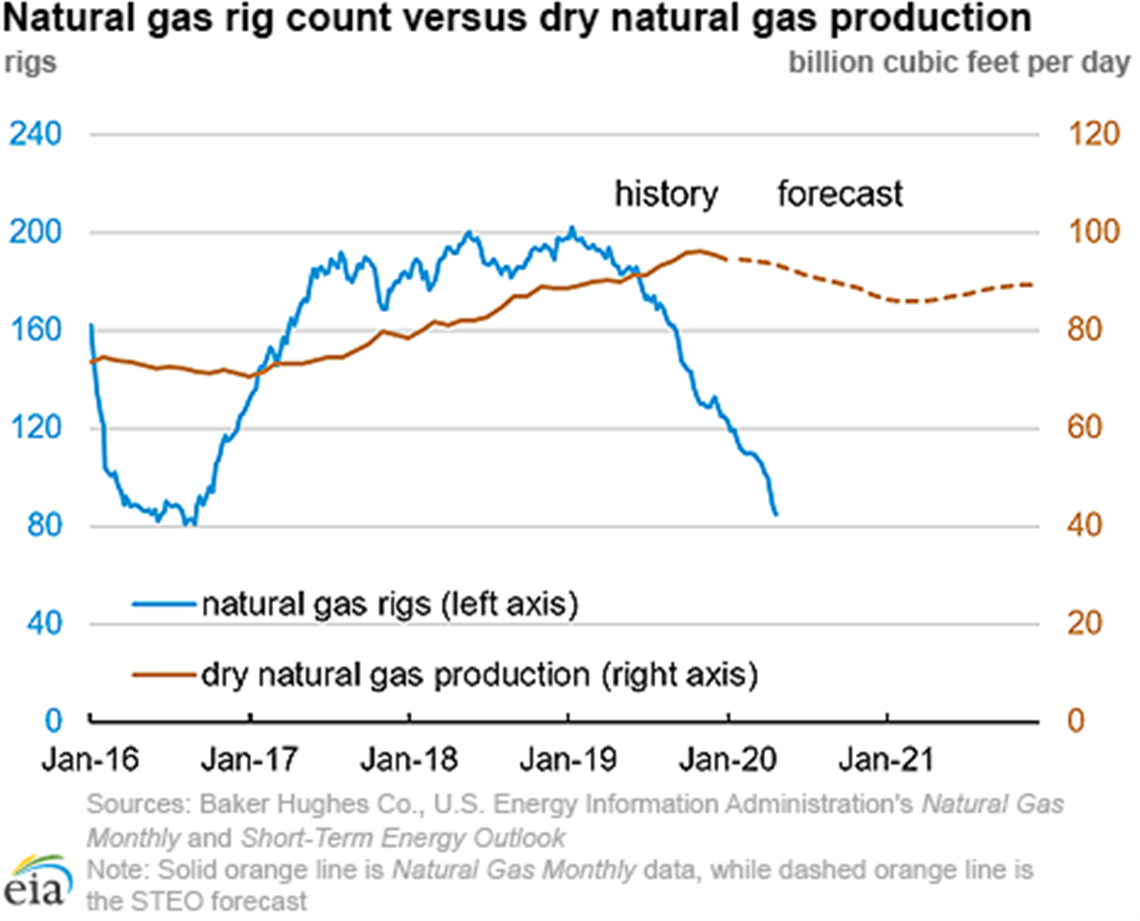

The number of active natural gas rigs in the United States fell to 85 on April 21, the lowest number of active natural gas rigs since August 2016, according to data from Baker Hughes Co. As of that date, there were 38 fewer (31%) active natural gas rigs than at the beginning of 2020 and 101 fewer (54%) than last year at the same time. Natural gas-directed rigs remained concentrated in the Marcellus Basin in Ohio, Pennsylvania, and West Virginia and in the Haynesville Basin in Louisiana and Texas. These two basins accounted for 50% of the decrease in natural gas-directed rigs over the past year, and 78% of remaining natural gas-directed rigs in the United States operate in these basins.

The natural gas rig count peaked at 202 rigs on January 8, 2019, according to Baker Hughes data, the highest level since 2015. During January 2019, the Henry Hub spot price averaged $3.05 per million British thermal units (MMBtu). By the beginning of 2020, the Henry Hub spot price averaged $2.00/MMBtu, which is historically low for that time of year. One short-term factor contributing to the current low-price environment is lower demand related to unseasonably warm weather. A longer-term factor affecting the price decrease is related to rapid growth in dry natural gas production relative to consumption levels.

Production rose in 2019 even though the rig count decreased, reaching a record-high 96.3 billion cubic feet per day (bcf/d) of dry natural gas production in November. Since then, dry natural gas production has declined as relatively low natural gas prices have diminished the economic incentive for producers to drill new natural gas wells. Similarly, associated natural gas production has fallen as the lower price of oil has reduced the incentive to drill oil wells. Completion of drilled but uncompleted wells (DUCs) has likely offset some of the decrease in production from newly drilled wells. According to EIA’s most recent Drilling Productivity Report, as of March 2020, the number of DUCs was 13% (1052 DUCs) lower than the peak in May 2019. This drop indicates that more wells are being completed than are being drilled.

EIA’s latest Short-Term Energy Outlook (STEO) forecasts dry natural gas production to continuing falling through next year from 94.5 bcf/d in January 2020 to 85.9 bcf/d in March 2021, after which EIA forecasts production will increase again.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM