U.S. gas prices expected to climb further

February 08, 2022

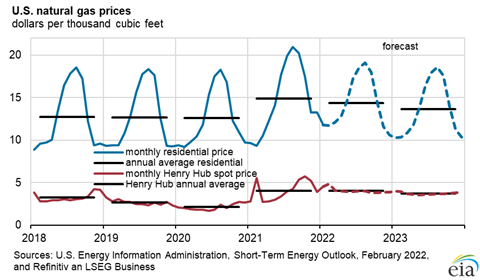

Spot prices for natural gas at Henry Hub are expected to average around $4.70/MMBtu for the month of February, according to the latest forecast from the U.S. Energy Information Administration.

The agency’s latest Short-Term Energy Outlook stated that the spot price for gas at Henry Hub averaged $4.38/MMBtu in January, up from $3.76/MMBtu in December. The increase in prices from December stem from colder-than-normal weather in parts of the country, particularly in the Northeast and Midwest, where demand for gas for heating and power generation increased.

The agency’s outlook uses weather forecasts from the National Oceanic and Atmospheric Administration (NOAA) from late January to make its forecast for gas prices in February. It noted that global demand for U.S. liquefied natural gas (LNG) remains high, which limits some of the downward pressure on natural gas prices.

“We expect natural gas prices could remain volatile over the coming months, and the way that temperatures affect natural gas demand in February and March will be a key driver of how inventories end the withdrawal season, which will be important for natural gas price formation in the coming months,” the EIA stated.

The EIA estimated that that U.S. LNG exports averaged 11.2 Bcf/d in January 2022, up from 10.4 Bcf/d in 4Q21. The increase in exports stems largely from large price differences between the Henry Hub price in the United States and spot prices in Europe and Asia.

In addition, inventories in Europe remain much lower than their five-year averages and are contributing to strong demand for LNG imports. The agency predicted that U.S. LNG exports will remain strong in 2022, averaging 11.3 Bcf/d for the year, a 16% increase from 2021.

The forecast is based on the assumptions that global natural gas demand will remain strong and that expected additional export capacity will come online as expected.

Temperatures in January were colder than normal, which caused U.S. natural gas inventories to fall below the five-year average to end the month at 2.3 trillion cubic feet (Tcf). The EIA said it expected natural gas inventories to fall by about 730 Bcf for the rest of the withdrawal season, ending March just below 1.6 Tcf, which would be 8% less than the 2017–21 average for that time of year.

Natural gas consumption will average 105.2 Bcf/d in February, down 3% from a year earlier. Consumption in the residential and commercial sectors is expected to fall 10% from last February to 43.8 Bcf/d. Consumption among U.S. power producers is expected to reach 27.8% in February, down 10% from a year earlier.

The decline in those sectors is partially offset by a 4% increase in consumption among industrial users, according to the EIA forecast.

Dry natural gas production averaged 95.5 Bcf/d in the U.S. in January, down 2.1 Bcf/d from December. The decline was caused by freezing temperatures in some producing regions. For February, the agency forecast that dry gas production would average 95.6 Bcf.d and 96.1 Bcf.d for all of 2002. Looking forward to 2023, the agency said it expected total production to average of 98.0 Bcf/d.

The strength in oil and gas pries is expected to drive production higher this year. Electricity generators are expected to get 35% of their production from natural gas in 2022 and 2023, down from 37% in 2021, the EIA said.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM