Spot gas prices in U.S. expected to climb further

June 14, 2022

The spot price for natural gas at Henry Hub is expected to average $8.69/MMBtu in 3Q22, up from an average of $8.13/MMBtu in May, according to the latest forecast from the U.S. Energy Information Administration.

Three factors are causing the increase in gas prices: low inventories, steady demand for LNG exports from the U.S. and ongoing demand from power producers in the U.S. who want to switch from coal. Looking further forward, the EIA said it expected spot prices at Henry Hub to average $4.74/MMBtu in 2023 as gas production starts to catch up with the demand.

In its latest Short Term Energy Outlook, the EIA reported U.S. natural gas inventories ended May at 2.0 trillion cubic feet (Tcf), about 15% below the five-year average. Natural gas inventories are expected to end October (the end of the injection season), at just above 3.3 Tcf, about 9% below the five-year average.

U.S. LNG exports should average 11.7 Bcf/d in 2Q22 and 3Q22 and 11.9 Bcf/d for all of 2022, up 22% from 2021. The increase in exports stems from additional U.S. LNG export capacity that has come online. By 2023, exports should increase further to 12.6 Bcf/d because of new export terminals expected to come online in mid 2022, according to the outlook.

The EIA said it expected U.S. consumption of natural gas to average 85.3 Bcf/d in 2022, up 3% from 2021. The higher gas consumption reflects increased consumption across all sectors. In the residential and commercial sectors, increasing consumption results from colder temperatures in 2022 than in 2021, and in the industrial sector, rising economic activity contributes to higher consumption. Limited natural gas-to-coal switching in the electric power sector, despite high natural gas prices, results in increased consumption of natural gas for power generation.

“For 2023, we forecast that natural gas consumption will average 85.1 Bcf/d, about the same as 2022,” the agency stated. Dry natural gas production is expected to climb from around 95.7 Bcf/d in June to 97.9 Bcf/d in 2H22, about 3% more than a year earlier. By 2023, production should average 101.6 Bcf/d.

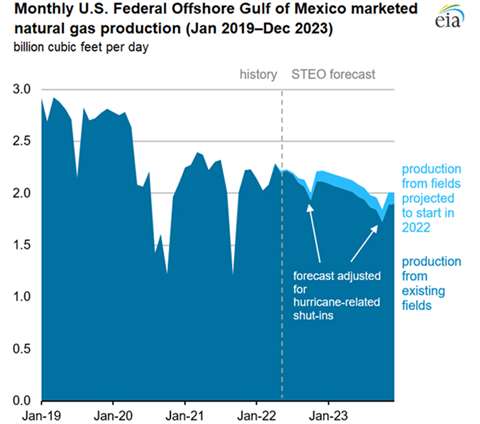

The EIA also forecast that gas production from the U.S. Gulf of Mexico will decline even as nationwide production is expected to climb. GOM natural gas production will average 2.1 billion cubic feet per day (Bcf/d) in 2023, down from 2.2 Bcf/d in 2022.

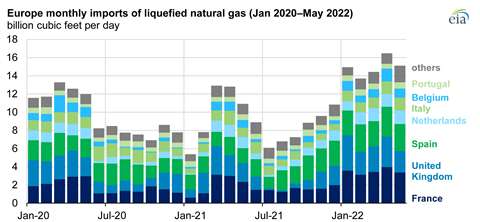

As U.S. gas production and exports were climbing, Europe’s imports of LNG rose to an all-time high in April, averaging 16.5 Bcf/d in April. Imports are climbing because inventories are historical lows and its pipeline imports from Russia have fallen dramatically. European spot prices have generally been stronger than in other regions, which has drawn supplies from suppliers who have destination flexibility built into their contracts.

From January through may, LNG imports into the European Union and the United Kingdom averaged 14.9 Bcf/d, up 66% from the same period one year earlier.

Fourteen countries in Europe have LNG import terminals, but utilization of these facilities varies by region. Terminals in northern and southern European pipeline grid is not fully integrated. LNG import terminals in Northwest Europe are better integrated, which enables them to transport large quantities of gas to the storage and demand centers.

LNG import facilities in Southern Europe primarily serve local and regional markets. From January through May, regasified LNG sent to the pipeline grid in Spain, Portugal, and Italy in Southern Europe averaged 4.6 Bcf/d. Those terminals were used about 58% of their capacity, the EIA reported.

Also from January through May, regasification terminals in France, Belgium and the Netherlands averaged 5.8 Bcf/d, a level of imports which exceeded the nameplate capacity of the facilities by 15%.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM