China Gas Use Tops Production

October 23, 2019

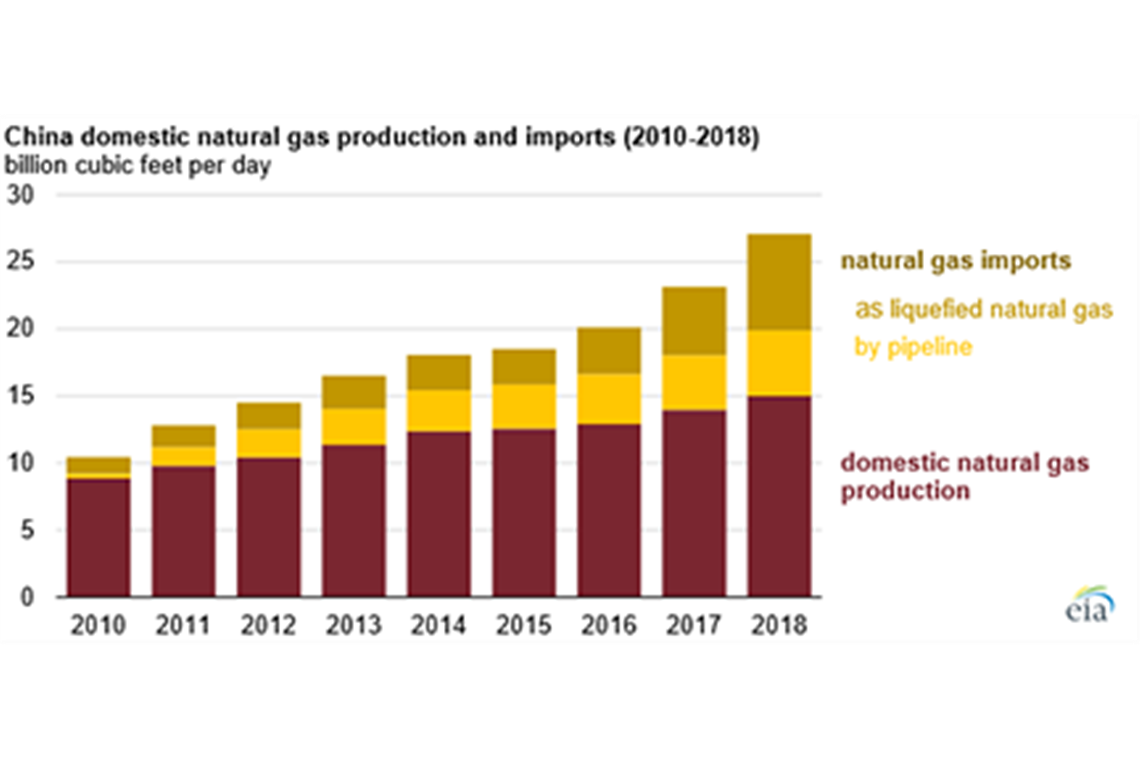

Rapid growth in China’s natural gas consumption has outpaced growth in its domestic natural gas production in recent years, according a recent report from the U.S. Energy Information Administration (EIA).

China’s natural gas imports, both by pipeline and as liquefied natural gas (LNG), accounted for nearly half (45%) of China’s natural gas supply in 2018, an increase from 15% in 2010. To increase domestic production of natural gas, the Chinese government has introduced incentives for several forms of natural gas production.

Natural gas production has recently grown in China largely because of increased development in low-permeability formations in the form of tight gas, shale gas, and to a lesser extent, coalbed methane. In September 2018, the Chinese State Council set a target of 19.4 bcfd) for domestic natural gas production in 2020. In 2018, China’s domestic natural gas production averaged 15.0 bcfd.

In June, the Chinese government introduced a subsidy program that established new incentives for production of natural gas from tight formations and extended existing subsidies for production from shale and coalbed methane resources. This subsidy is scheduled to be in effect through 2023. In addition to the changes in the subsidy program, the government allowed foreign companies to operate independently in the country’s oil and natural gas upstream sector.

Production of tight gas, shale gas, and coalbed methane collectively accounted for 41% of China’s total domestic natural gas production in 2018. China has been developing tight gas from low-permeability formations since the 1970s, especially in the Ordos and Sichuan Basins. Tight gas production was negligible until 2010, when companies initiated an active drilling program that helped lower the drilling cost per vertical well and improve well productivity.

Production of tight gas, shale gas, and coalbed methane collectively accounted for 41% of China’s total domestic natural gas production in 2018. China has been developing tight gas from low-permeability formations since the 1970s, especially in the Ordos and Sichuan Basins. Tight gas production was negligible until 2010, when companies initiated an active drilling program that helped lower the drilling cost per vertical well and improve well productivity.

Shale gas development in China has focused on the Sichuan Basin. China National Petroleum Corp.’s (CNPC) subsidiary PetroChina operates two fields in the southern part of the basin and the China Petroleum and Chemical Corp. (Sinopec) operates one field in the eastern part of the basin. PetroChina and Sinopec have respectively committed to produce 1.16 bcfd and 0.97 bcfd of shale gas by 2020, which, if realized, would collectively double the country’s 2018 shale gas production level.

China’s coalbed methane development is concentrated in the Ordos and Qinshui Basins of Shanxi Province. These basins face significant challenges, including relatively low well productivity and relatively high production costs.

China’s coalbed methane development is concentrated in the Ordos and Qinshui Basins of Shanxi Province. These basins face significant challenges, including relatively low well productivity and relatively high production costs.

China also generates synthetic natural gas from coal, a source that accounted for 2% of China’s natural gas production in 2018. China’s synthetic gas projects involve gasifying coal into methane in coal-rich provinces, such as Inner Mongolia, Xinjiang, and Shanxi. In 2016, the Chinese government hoped to reach 1.64 bcfd of coal-to-gas production capacity by 2020. China’s coal-to-gas production was less than 0.3 bcfd in 2018 as stricter environmental mandates have slowed down plant construction and increased the cost of further developing coal-to-gas.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM