Read this article in Français Deutsch Italiano Português Español

What’s in store for 2024?

December 21, 2023

What business leaders, analysts are saying about next year

(Editor’s note: This story originally appeared in the December issue of COMPRESSORtech2 magazine.)

A quote, often attributed to the old major league baseball manager Casey Stengel, goes something like this: “Never predict anything, especially the future.”

There’s also a line about the best laid plans still, thinking about trends and trying to ascertain what the next six, 12, 18 months will bring is both good business practice and part of human nature.

To get insight into what 2024 might hold for the industry, COMPRESSORtech2 looked to what company leaders and industry analysts themselves were saying about next year. We scoured earning reports, board presentations and industry analysis to find what people were willing to put on the record. Generally, most expressed optimism about the upcoming 12 months. Here’s a sampling of what we found.

Kinder Morgan

“We expect to finish 2023 slightly below our plan on a full-year basis, due to lower-than-expected commodity prices, delayed RNG (renewable natural gas) projects and higher pipeline integrity expense,” the company said.

However, CEO Kimberly Allen Dang said in a post-earnings call “the 2024 curve is above 2023” and there are a “lot of tailwinds coming in this business.”

“Storage rates have increased significantly. So we’re able to charge more for storage. Obviously, on our contracts and Products and Terminals, we have inflation escalators, which help increase the EBITDA in those businesses.”

Industry analysts

Water Tower Research issued a report on trends to watch in 2024 for natural resources, including natural gas.

According to the report, which was authored by Jeff Robertson, managing director, LNG exports are expected to grow to 12.29 Bcf/d in 2024 from 11.80 Bcf/d in FY23 and 10.59 Bcf/d in FY22. More than 9 Bcf/d of LNG export capacity is under construction along the US Gulf Coast and scheduled to come into service by 2027.

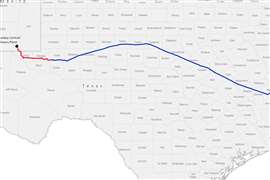

“Exporting US natural gas to global markets could underpin stronger pricing in the coming years, benefiting producers in gas-dominant regions such as the Haynesville Shale and Marcellus, and provide support to Permian Basin natural gas pricing,” the report states.

Consolidation in the industry is another trend to watch.

“The recently announced ExxonMobil/Pioneer Natural Resources and Chevron/Hess transactions demonstrate a desire to take costs out of the business and increase operating efficiency,” the report said. “The same objectives are at work in smaller corporate combinations transactions between Permian Resources and Earthstone as well as public companies acquiring private equity portfolio companies. We expect the trend to continue in 2024 and that consolidation will put more assets into the market as portfolios are optimized creating growth opportunities for companies across the size spectrum. Companies with strong balance sheets could capitalize on acquisition opportunities to high-grade their asset bases.”

Decarbonization technologies, such as carbon capture, will likely grow in importance, the report said.

“Many companies in the broad natural resources sector are directly participating in and/or evaluating opportunities to capitalize on decarbonization,” the report states. “Carbon capture and sequestration (CCS) has generated a significant amount of interest from investors trying to understand the commercial terms of the opportunity set. Through its subsidiary 1PointFive, Occidental Petroleum is leading the construction of the Stratos Direct Air Capture (DAC) facility in Ector County, Texas. Stratos is expected to be the largest DAC facility in the world with the capacity to capture 500,000 tons of atmospheric CO2 per year when commercial operations begin in mid-2025.

Kodiak Gas Services

Kodiak Gas Services, one of the largest contract compression services providers in the U.S., saw record third-quarter financial results, according to Mickey McKee, the company’s founder and CEO. He told investors that 2024 looks strong as well.

“We exited the third quarter with 99.9% utilization and our planned 2023 horsepower additions are fully contracted, giving us great confidence in our revised full-year outlook,” McKee said. With lead times on new equipment orders remaining at a year or more, we are nearly fully contracted on our 2024 deliveries and already in discussions with our customers on their 2025 needs. The rates on new unit deployments continue to provide an attractive return on capital.”

McKee added, “large horsepower compression remains in high demand from our customers, and we see significant tailwinds for natural gas infrastructure growth, particularly in the Permian Basin, where over 70% of our horsepower is deployed. We’re focused on growing our fleet in the best basins with the best customers while delivering the highest level of service in the industry.”

Goldman Sachs

On the global economy, Jan Hatzius, Goldman Sachs Chief Economist and head of Global Investment Research, sees mostly positives next year.

In fact, his firm’s Macro Outlook for 2024 report has the optimistic title of “The Hard Part is Over”.

The report cites several tailwinds to global growth in 2024, including strong real household income growth, a smaller drag from monetary and fiscal tightening, a recovery in manufacturing activity, and an increased willingness of central banks to deliver insurance cuts if growth slows.

More disinflation is in store over the next year as well. But the report didn’t discount the possibility of a downturn.

“Despite the good news on growth and inflation in 2023, concerns about a recession among forecasters haven’t declined much,” the report states. “Even in the US, which has outperformed so clearly on growth in the past year, …the median forecaster still estimates a probability of around 50% that a recession will start in the next 12 months. This is down only modestly from the 65% probability seen in late 2022 and far above our own probability of 15% (which in turn is down from 35% in late 2022).”

Natural gas demand

In late fall, the International Energy Agency (IEA) released an updated report on global natural gas demand.

After a decade of unprecedented expansion, the IEA expects growth in global demand for natural gas to slow in the coming years as consumption declines in mature markets.

Global gas demand is on course to grow by an average of 1.6% a year between 2022 and 2026, down from an average of 2.5% a year between 2017 and 2021, said the Gas 2023 Medium-Term Market Report. The report notes that the advent of the global energy crisis in 2022, triggered by Russia’s invasion of Ukraine, has ushered in a different era for global gas markets after their decade of strong growth between 2011 and 2021.

Overall gas demand from mature markets in Asia Pacific, Europe and North America peaked in 2021, and is forecast to decline by 1% annually through to 2026, according to the report. A rollout of renewables and improved energy efficiency are among the key drivers behind the downward trend for natural gas in these markets.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM