Tight supplies expected to push 4Q21 U.S. gas prices higher

November 05, 2021

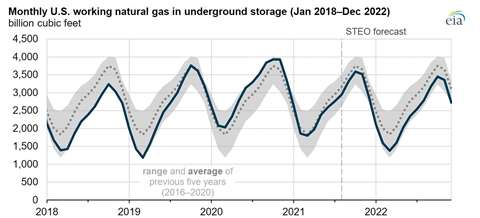

U.S. natural gas inventories are behind the five-year average for this time of the year, the EIA reported.

U.S. natural gas inventories are behind the five-year average for this time of the year, the EIA reported.

Fourth quarter 2021 spot gas prices at Henry Hub are expected to average $5.80/MMBtu, according to the latest forecast from the U.S. Energy Information Administration. That forecast is $1.80/MMBtu higher than the agency’s previous forecast, boosted by stronger demand and an ongoing tightening of world gas supplies.

“We forecast that U.S. inventory draws will be slightly more than the five-year average this winter, and we expect that factor, along with rising U.S. natural gas exports and relatively flat production through January will keep U.S. natural gas prices near recent levels before downward pressures emerge,” the agency predicted.

In addition to the stronger gas prices this winter, the EIA forecast additional volatility because of the low level of inventories in the U.S. and Europe. Winter temperatures will be a key driver of both demand and prices, the EIA forecast.

By January, spot prices at Henry Hub are expected to reach a monthly average of $5.90/MMBtu and then generally decline through 2022 to average $4.01/MMBtu for the year as stronger U.S. production continues to recover. The agency forecast that LNG exports will continue to grow, although at a slower pace than previously expected.

U.S. LNG exports averaged 9.3 Bcf/d in September, down 4% from August. The decline was caused by the suspension of piloting services for several days at Sabine Pass, Cameron and Corpus Christi. Total LNG exports for October are not available, but the agency said the total to fall again to an average 9.1 Bcf/d and then increase in the coming months.

Cove Point LNG terminal was scheduled to complete its annual maintenance by mid-October and then resume exports after that. Through the winter, the EIA expected LNG exports to be around 10.7 Bcf/d as global natural gas demand remains high and several new LNG export trains enter service. The sixth train at Sabine Pass LNG and the first trans at the new LNG export facility at Calcasieu Pass are scheduled to come online soon, the EIA reported.

Gas inventories are tight this year for several reasons. Summer injections into storage this summer were lower than the previous five-year average mostly because of demand from electricity producers and strong exports. The agency reported that U.S. inventories ended September at about 3.3 Tcf, about 5% less than the five year average for that time of the year.

Although final totals are not yet available, the EIA said it expected U.S. inventories to end the 2021 injection season (traditionally around the end of October) at almost 3.6 Tcf, also 5% below the five-year average. Total inventories are expected to fall by 2.1 Tcf this winter and end March 2022 with less than 1.5 Tcf in storage. That total would be 12% less than the 2017 -2021 average for that time of year.

Total dry natural gas production averaged 93.3 Bcf/d in the U.S. during Q3, up from 91.6 Bcf/d in the first half of the year. Looking forward, the EIA forecast U.S. production to reach 94 Bcf/d in the winter and then average 96.4 Bcf/d for all of 2022. The stronger production will be caused by higher gas prices.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM