Spot prices for natural gas expected to ease in 2022

January 11, 2022

Spot prices for U.S. natural gas at Henry Hub should average $3.79/MMBtu in 2022, down from an average of $3.91/MMBtu in 2021, according to the latest short-term energy outlook from the U.S. Energy Information Administration.

The average Henry Hub spot price for natural gas will be $3.82/MMBtu in Q1, and natural gas inventories will ease to around $3.78/MMBtu for the next three quarters as inventory levels remain near the five-year average levels, the EIA forecast.

Looking further ahead to 2023, the EIA forecast gas prices to slip further, to around $3.63/MMBtu.

“Although we expect natural prices to decline in 2022 and 2023 compared with 2021, prices in the forecast stay relatively high compared with recent years,” the EIA reported. “This dynamic is partly the result of reductions in coal-fired electricity-generating capacity and ongoing constraints in the coal market, which make increases in coal generation (and associated decreases in natural gas generation) less sensitive to rising natural gas prices than they have been in recent years.”

In addition, weather-related incidents could lead to additional natural gas volatility and uncertainties about the effects of natural gas exports, the EIA reported.

Natural gas consumption in the U.S. averaged 83 billion cubic feet per day (Bcf/d) in 2021, virtually unchanged from the prior year. Looking forward, U.S. natural gas consumption will remain essentially the same in 2022 and 2023, according to the EIA outlook.

The electric power sector, the largest gas-consuming sector in the U.S., will consume an average of 28.8 Bcf/d in 2022, about 6% less than in 2021. This decline is the result of additional capacity from renewable energy. The consumption of natural gas in the electric power sector should fall by 0.5 Bcf/d, or 2%, in 2023, the EIA reported.

Gas consumption from the industrial sector should increase by 3% to an average of 23.2 Bcf/d in 2022 and to 23.5 Bcf/d in 2023 as demand for industrial goods and economic activity increases, the EIA predicted.

“We expect combined U.S. residential and commercial natural gas consumption will average 22.6 Bcf/d in 2022, up 4% from 2021,” the EIA wrote. Colder than usual weather, as predicted from National Oceanic and Atmospheric Administration forecasts, assumes 6% more heating days across the U.S. As a result, gas consumption in the residential and commercial sectors should increase by 1% to 22.8 Bcf/d in 2023.

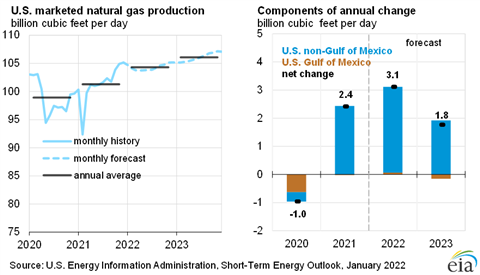

Dry natural gas production in the U.S. should increase 3%, or 2.5 Bcf/d in 2022, boosted by recent increases in domestic natural gas prices and increasd drilling activity expected in 2022.

The Haynesville region, where production tends to be senstivei to changes in the benchmark Henry Hub natural gas prices, and the Permian Basin, are expected to lead the additional production. Looking further forward, the EIA forecast that dry natural gas would increase further by 1.5 Bcf/d to reach 97.6 Bcf/d in 2023.

Natural gas exports are expected to reach record highs in 2022 and to grow further in 2023. Net exports averaged 10.7 Bcf/d in 2021 and are expected to reach 13.4 Bcf/d in 2022 and 14.3 Bcf/d in 2023. The larger exports are caused by an ongoing increase in LNG exports and pipeline exports, the EIA forecast.

U.S. producers exported an estimated 11.2 Bcf/d of LNG in December, an increase of 0.7 Bcf/d over the previous record in November. The growth in LNG exports is caused by the rising demand for natural gas and strong LNG prices in Europe and Asia and by reductions in global supplies. Those supplies contracted in response to unplanned outages at LNG export facilities worldwide.

U.S. LNG exports will reach 11.5 Bcf/d in 2022, up from 9.8 Bcf/d in 2021. Looking further forward, the EIA predicted LNG exports will average 12.1 Bcf/d in 2023.

The additional LNG exports stem from the completion of Train 6 and Sabine Pass, the optimization of operations at Sabine Pass and Corpus Christi LNG terminals and the completion of a new facility at Calcasieu Pass in 2022, the EIA predicted.

“These expansions will increase total U.S. LNG export capacity in2022 to become the world’s largest,” the EIA reported. As of December, existing U.S. LNG baseload liquefaction capacity was 10.1 Bcf/d and peak capacity was 12.2 Bcf/d. By the end of 2022, U.S. baseload capacity will increase to 11.4 Bcf/d and peak capacity will increase to 13.8 Bcf/d, the EIA forecast.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM