Read this article in Français Deutsch Italiano Português Español

Report: LNG market faces decade of capacity growth and shifting demand

November 12, 2025

IEA forecasts diverging outcomes through 2035 as Asia, Europe, and the United States redefine gas trade dynamics

Global liquefied natural gas (LNG) markets are heading into a decade of significant capacity expansion—but uneven demand growth and regional energy transitions could reshape how that supply is absorbed, according to the International Energy Agency’s (IEA) World Energy Outlook 2025.

The report outlines diverging scenarios for LNG demand to 2035, with the balance between capacity additions and consumption growth hinging on the pace of electrification, renewable energy deployment, and infrastructure buildout across key import regions.

Strong capacity growth meets uneven demand

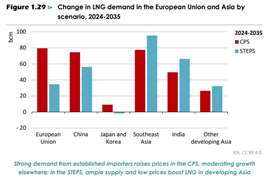

Under the IEA’s Current Policies Scenario (CPS)—which assumes limited progress in energy transition policies—global LNG demand increases by roughly 260 billion cubic meters (bcm) between 2024 and 2030, effectively absorbing the surge in new liquefaction capacity now under construction. In this case, LNG prices remain close to the long-run marginal cost of supply, reflecting the need to recover the full capital costs of liquefaction, shipping, and regasification infrastructure.

Half of the projected demand increase would come from established importers such as China, Europe, and Japan, while developing economies in South and Southeast Asia also see strong growth. However, high gas prices could constrain uptake in lower-income markets. By 2035, about 20 bcm per year of additional export capacity would be required beyond the projects currently built or under development.

By contrast, in the Stated Policies Scenario (STEPS)—which factors in stronger renewable growth and efficiency gains—global LNG demand grows by only 200 bcm between 2024 and 2030. That growth lags new export capacity, leading to an LNG surplus of roughly 65 bcm in 2030. Excess supply keeps prices near short-run marginal costs and provides cheaper LNG to price-sensitive markets such as India and Southeast Asia.

Europe’s demand declines, but LNG import reliance deepens

Europe’s LNG imports surged after the loss of Russian pipeline gas in 2022, and the region remains one of the world’s largest LNG markets through 2035. The IEA projects that European natural gas demand peaked in 2010 and fell another 20% between 2021 and 2024.

In both the CPS and STEPS, demand continues to decline as electrification and renewables reduce consumption—but imports rise as domestic production and pipeline flows wane. In the CPS, EU gas demand drops by 35 bcm while LNG imports rise 80 bcm to 2035. Under the more ambitious STEPS pathway, demand falls by 75 bcm, with LNG imports up 35 bcm. Despite lower overall gas use, LNG will remain vital for system flexibility, seasonal storage, and energy security across Europe.

Asia drives consumption, led by China and emerging economies

Asia remains the global growth engine for LNG consumption, although trajectories vary sharply by country.

China, which has absorbed about 35% of global LNG growth since 2015, remains a “wild card,” the IEA said. LNG imports are expected to be lower in 2025 than in recent years as domestic output rises and Russian pipeline imports expand. The potential for a second Power of Siberia pipeline could further curb LNG demand later in the decade.

In the STEPS, Chinese LNG demand climbs from 110 bcm in 2024 to 165 bcm in 2035, while in the CPS it reaches 180 bcm amid slower renewable expansion.

Elsewhere in Asia, India and Southeast Asia stand out as fast-growing LNG markets. Lower prices—averaging about $7.50 per million British thermal units (MMBtu) between 2030 and 2035—could triple India’s LNG imports and quadruple Southeast Asia’s, provided infrastructure keeps pace. Many regasification terminals remain in the planning phase, and downstream networks in India are still insufficient to fully utilize existing terminals.

Even at lower price levels, LNG remains a premium fuel in many emerging markets, limiting its potential as a baseload option. Instead, abundant LNG supply may act as a strategic buffer for security of supply and system reliability.

Exporters face utilization and investment risk

The IEA warns that a period of surplus supply could strain exporters—especially those with flexible output such as the United States. Under the STEPS, weaker utilization rates may make it difficult for some projects to recover full investment costs.

U.S. portfolio players with exposure to spot and short-term trading face the most risk, though liquefaction plant owners are partially shielded by capacity-based contracts. Similar under-utilization pressures could also emerge at older, higher-cost plants in other exporting nations as legacy contracts expire and buyers exercise flexibility clauses.

Can cheap LNG displace coal in Asia?

A key uncertainty in global gas balance is how much coal-to-gas switching can absorb the wave of new LNG supply. The IEA estimates that about 400 bcm of technically feasible switching potential exists in Asia’s power and industrial sectors by 2030.

If delivered LNG prices fall to $5 per MMBtu, an additional 100 bcm of coal-to-gas switching could occur—mainly in China’s power sector. But since the long-run marginal cost of LNG supply is well above $5 per MMBtu, sustained prices at that level are unlikely. Moreover, regulatory protections for coal plants, long-term supply contracts, and infrastructure constraints limit the short-term flexibility to switch fuels.

Long-term implications for compression and infrastructure

For LNG equipment suppliers and gas infrastructure developers, the IEA’s outlook suggests a two-track market. Established importers will rely on LNG for reliability and system stability, demanding continued investment in storage, compression, and regasification capacity. In emerging Asia, the opportunity lies in cost-efficient, modular infrastructure that can handle intermittent demand growth and integrate with renewables.

Even in a lower-demand environment, new compression technologies, electrified drive systems, and flexible liquefaction capacity will be essential to maintain utilization rates and economic efficiency across an increasingly dynamic global LNG network.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM