PG&E reclassifies 51 Bcf of working gas

June 25, 2021

The reported inventory of natural gas storage facilities held by at Pacific Gas and Electric fell abruptly from 72.9 Bcf to 22.0 Bcf in the first half of June, according to a recent report from the U.S. Energy Information Administration.

The abrupt decline was not the result of a sudden outflow of gas, but the reclassification of 51 Bcf of working natural gas storage to base gas. Although the reclassification resulted in a large decrease in working gas levels in the Pacific region for the week ending June 11, the reclassification is a non-flow related change that has no effect on the total natural gas in storage (base gas plus working gas), the EIA reported.

Base gas reflects the amount of gas needed to maintain adequate reservoir pressure and deliverability rates throughout the withdrawal season. The reclassification was the single largest day reduction in working gas ever reported at the PG&E facility, surpassing the withdrawals from the heating season that stretched from November through March.

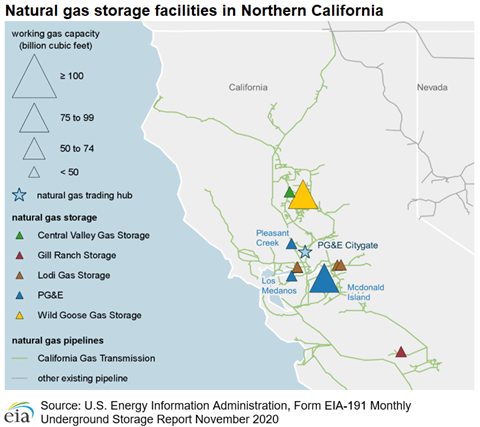

A total of 69 Bcf was withdrawn during the 2013-2014 heating season, but since then net seasonal withdrawals never exceeded 47 Bcf and working gas inventories never fell below 34 Bcf. Prior to the reclassification, PG&E’s working gas capacity totaled 102 Bcf at three natural gas storage fields: McDonald Island, with 82 Bcf, Pleasant Creek, with 2.3 Bcf, and los Medanos, with 17.9 Bcf. PGE&E’s working gas capacity made it the 10th largest storage operator in the U.S. After the reclassification, the company’s working gas capacity still exceeds 51 Bcf, the EIA reported.

The reclassification of the stored gas is part of a change in focus in how the company uses its storage facilities. It is using the stored gas to ensure system reliability rather than as a commodity price management tool. The narrower operational mission will enable the company to serve customers with fewer natural gas storage assets, the EIA reported.

In addition to maintaining larger base gas levels in its storage facilities, the company plans to sell or decommission the Pleasant Creek and Los Medanos fields in 2021, a plan the California Public Utilities Commission has already approved.

Nationwide, working gas stocks totaled 2482 Bcf, 154 Bcf lower than the five-year average for this time of year. In addition, nationwide net injections into storage totaled 55 Bcf for the week ending June 18, compared with the five-year average of 83 Bcf, the EIA reported.

The spot price for gas at Henry Hub rose 16 cents from $3.17/MMBtu to $3.33/MMBtu earlier this week. A large part of the increase stems from an increase in demand from Texas power producers who saw a surge in demand for electricity. Prices in Katy, Texas, also increased this report week from $3.21/MMBtu to $3.32/MMBtu. Gas prices also surged as electricity from wind farms fell last week, the EIA reported.

The total supply of natural gas nationwide fell by 0.1% this week, compared with the previous report week, according to IHS Markit. Dry natural gas production grew by 0.2% compared with the previous report week and continues to remain at or above the five-year (2016–2020) range of dry natural gas production.

U.S. consumption of natural gas fell by 1.8% this week. Natural gs consumption for power generation fell by 4.3% from last week, according to data from IHS Markit. Meanwhile, gas deliveries to U.S. liquefied natural gas (LNG) export facilities averaged 10 Bcf/d, up 0.54 Bcf/d from last week and well above the five-year average.

Total LNG exports from 17 LNG vessels with a carrying capacity of 62 Bcf left the U.S. between June 17 and June 23, Bloomberg reported.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM