Natural gas crisis to lead to supply shortages

October 31, 2022

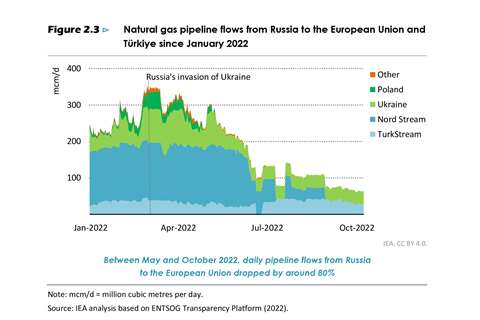

Natural gas flows from Russia to Europe have fallen dramatically since the start of the year. (Graph: International Energy Agency.)

Natural gas flows from Russia to Europe have fallen dramatically since the start of the year. (Graph: International Energy Agency.)

Russia’s invasion of the Ukraine earlier this year has shaken international natural gas markets and will leave consumers worldwide exposed to higher energy bills and supply shortages, according to a recent report from the International Energy Agency.

The current crisis is broader and more complex than anything the world has seen before, the IEA stated in its recently released World Energy Outlook.

“Today, the world is in the midst of the first truly global energy crisis, with impacts that will be felt for years to come,” said Fatih Birol, IEA executive director. “Russia’s unprovoked invasion of Ukraine in February has had far‐ reaching impacts on the global energy system, disrupting supply and demand patterns and fracturing long‐standing trading relationships.”

The high prices caused by the crisis have led to a huge transfer of wealth from consuming nations to producing nations. The crisis has led to inflationary pressures and created fears of a global recession. It has also led to a $2 trillion windfall for fossil fuel producers above their 2021 net income, the IEA reported.

The rising prices of energy mean that the number of people worldwide without access to modern energy is rising for the first time in a decade. About 75 million people worldwide who now have access to electricity will probably not have the ability to pay for it, the IEA reported.

At the end of September Russia’s exports of gas to the European Union had fallen by 80% when compared with historical levels. Europe demands more gas in the winter for heating and it is unclear how it will make up the shortfall, the IEA reported. The crisis has driven spot prices for natural gas to levels never seen before and has driven up oil and coal prices as well.

The global supply crisis has led to record price levels in multiple markets around the world and the IEA said it does not expect balance to return until the middle of the decade, when large new LNG export projects come into production.

The higher prices have slowed demand growth in Asian markets and has accelerated European efforts to reduce gas demand and led to a faster increase in the deployment of renewables. Global gas demand is expected to fall by 750 bcm by 2050 because of the lower expected GDP growth and the stronger gas prices.

“Europe’s scramble to reduce reliance on Russian fossil fuel imports takes centre stage, but the repercussions of Russia’s invasion of Ukraine are being felt much more broadly across a deeply interconnected global energy system,” the report stated.

Three scenarios

The World Energy Outlook from the IEA does not make a single forecast for the future of energy. Instead, it explores three alternatives of what might happen depending on how world policy makers respond to the gradual warming of the planet.

In the net zero emissions (NZE) scenario, the global energy sector would achieve net zero CO2 emissions by 2050. The announced pledges scenario (APS) shows the extent of the world’s ambition to tackle climate change as of mid 2022. The stated policies scenario (STEPS) explores where the energy industry might go without additional policy changes.

Under the STEPS scenario, the high price of energy is expected to restrict the growth in energy demand worldwide to around 1% annually through 2030. In this scenario, the demand for natural gas reaches a plateau by the end of 2030.

In all scenarios examined, the era of rapid growth in natural gas is coming to an end. In STEPS, the most optimistic for the natural gas industry, demand rises by less than 5% between 2021 and 2030 and then holds flat around 4.4 tcm through 2050. This is about 750 bcm lower in 2050 than the IEA had foreseen in previous annual outlooks. In the IEA’s STEPS analysis, the demand for natural gas is expected to rise at an average rate of 0.4% per year between 2021 and 2030, well below the 2.2% average rate of growth seen between 2010 and 2021.

In the NZE scenario, demand for natural gas falls further and faster than any other scenario, falling to 3.3 bcm in 2030 and 1200 bcm in 2050. This scenario would require the consumption of 1900 bcm of low emission gases (hydrogen, biogases and synthetic methane) would be consumed globally in NZE in 2050.

In all scenarios examined by the IEA, the EU compensates for the loss of Russian imports with a faster transition away from natural gas through a boost in capacity for renewable energy and a push to retrofit buildings and install heat points. In addition, the IEA expects additional LNG imports to offset the loss of Russian pipeline imports.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM