Methane certification designed to differentiate production

January 25, 2022

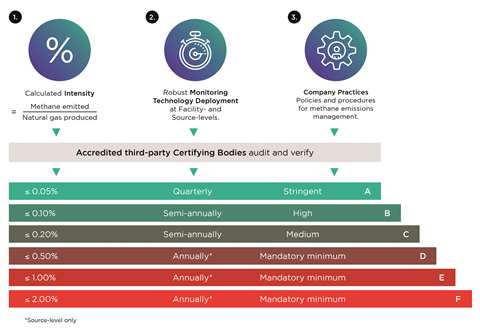

MiQ’s standards grade a facility’s production from “A” to “F” based on its methane emissions. Image courtesy of MiQ.

MiQ’s standards grade a facility’s production from “A” to “F” based on its methane emissions. Image courtesy of MiQ.

In an effort to differentiate sales of natural gas and to ultimately reduce methane emissions worldwide, a leading non-profit has started certifying methane production based on the amount of emissions from production facilities.

MiQ currently assesses around 10 Bcf/d, about 2.5% of the global gas market, using three main criteria: methane intensity, monitoring technology deployment and operating practices that promote a culture of emissions management.

MiQ’s standards grade a facility’s production from “A” to “F” based on its methane emissions. An A grade represents very low methane intensity (<0.05%) while F represents up to 2%.

“We wanted to drive action on a global basis. For that to happen, we knew gas needed to be differentiated based on emissions, which would lead to differentiated pricing,” said Lara Owens, U.S. Program Manager for MiQ. “This leads to cost and market incentives to reduce emissions for all operators in the system. We took what we believe are the most robust standards possible.”

Differentiated prices create market incentives for producers to cut methane emissions. In theory, methane emissions with a higher rating, which reflects a lower emissions intensity, would sell for a higher rate than methane with a lower grade.

MiQ spent over several years putting together its standards, borrowing from research and getting feedback from all stakeholders in the industry. The standards are listed on the MiQ website. “Our intention was for this to be very transparent,” she said.

Once the certificate is reached, it is entered into a methane intensity database.

MiQ sets the standards for methane emissions, but leaves it to third-party auditors to review the policies and procedures in place at a given operator. The auditor then issues the grade, which is entered into a registry.

The number of auditors is growing and, at the moment, MiQ has authorized 10 independent auditors and is examining four other others. The auditors are typically engineering or consulting companies who have been accredited and who are subject matter experts with experience in several core competencies: managing emissions, natural gas, emissions accounting and monitoring technologies.

The auditing process gives the certification additional credibility, Owens said. “We are not the judge, jury and executioner. There is a true third-party auditor who is doing all the decision-making.”

Certifying methane production through a third-party auditor gives sustainability reports issued by producers additional credibility, she said. “These certifications give producers the credibility to stand behind those (sustainability) reports,” she said. “Then once they get a certificate that is put in the registry. It is tied to the gas and can be sold and traded as an asset.”

The certificates from the production are not bundled with the actual production, meaning that they can be traded independently from the gas itself, Owens said.

The audit has a point system that looks at a producer’s best practices and its monitoring technology. “This gives producers an incentive and a path for improving emissions in an economical way,” she said.

MiQ started its certification program almost a year ago and, so far, has restricted certification to production assets only, Owens said.

All certifications issued to date are for gas production, but MiQ has established standards for midstream assets as well. It is now in the stakeholder review phase for establishing standards for boosting and gathering, processing, transmission and liquefied natural gas (LNG).

Other standards for methane certification exist, but MiQ is the first organization is the first to come out with transparent standards. Other “black box” standards exist, but they are not universally used because of their closed nature.

“Our goal is not to create our own special sauce, but to use something that the industry has come together and decided to adopt,” she said. It has added the third-party audit and a certification to it to create incentives for producers to do what many are already doing anyway.

A producer who wants to see its gas certified will pay the auditor, whose fees are comparable to an environmental assessment. There is also a small fee to the registry to cover the cost of issuing, tracking and retiring the certificates.

The audit itself starts with a review of documentation through which the auditor reviews standard operating procedures and conducts interviews with operators to understand the documentation. The auditor follows up with an on-site visit to interview the operators and examine the equipment, she said.

The time period for the audit can vary on how many assets the auditors need to examine and how well organized the documentation is. For those who are extremely well organized and have their documentation ready for review, it can take as little as for weeks. For others it can take up to 12 weeks.

“There is a lot of back and forth,” she said.

MiQ puts a lot of emphasis on procedures to ensure that operators can see the value and importance of methane. In some cases, companies have detailed policies and procedures written down, but the operators in the field don’t fully understand it. In other cases, the operators have an intrinsic understanding of best practices, but they are not clearly documented. MiQ’s certification process allows them to establish both, and boost the credibility of its sustainability reports.

When an auditor points these things out, a company can implement better technology or procedure before it can move forward with the certification process. The extra steps take longer, but enable a company to get a higher grade certification once those changes are implemented.

“All of this gives them a chance to say ‘I’m going to take a month or two to fix some of these things and then getter a better certification,’” Owens said.

MiQ strives to maintain the confidentiality of its clients, but some of the operators have announced their production is either certified or under review. Comstock Resources, Inc. recently announced a partnership with MiQ to independently certify its natural gas production in North Louisiana and East Texas. The company said it produces about 2.0 Bcf/d from its facilities in North Louisiana and East Texas.

BPX Energy, an affiliate of BP’s onshore U.S. business, recently announced it received an A-grade for its methane production in its South Haynesville basin wells in Texas. MiQ will issue one certificate for each MMBtu of certified natural gas from the 70 wells that make up BPX’s South Haynesville Facility, the company said.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM