Kinder Morgan buys North American Natural Resources

August 19, 2022

Kinder Morgan specializes in landfill-derived RNG, allowing its customers to switch directly to renewable fuel and derive the benefits of carbon credits. (Photo: Kinder Morgan.)

Kinder Morgan specializes in landfill-derived RNG, allowing its customers to switch directly to renewable fuel and derive the benefits of carbon credits. (Photo: Kinder Morgan.)

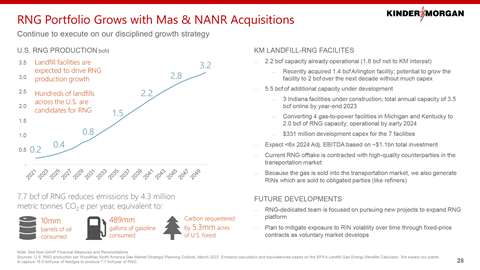

Kinder Morgan has closed on the acquisition of North American Natural Resources (NANR) and its sister companies, North American Biofuels and North American-Central. The $135 million acquisition in combined purchase price and related transaction costs includes seven landfill gas-to-power facilities in Michigan and Kentucky.

Shortly following close, KMI will make a final investment decision (FID) on the conversion of up to four of the seven gas-to-power facilities to renewable natural gas (RNG) facilities with a capital spend of approximately $175 million.

Pending FID, these facilities are expected to be in service by early 2024. Once complete, the facilities are expected to generate approximately 2 billion cubic feet (Bcf) per year of RNG. This acquisition follows the recent purchase of Kinetrex Energy and Mas CanAm acquisition.

The combined RNG operations will provide KMI with annual RNG generation capacity of approximately 7.7 Bcf per year once all of the RNG facilities are in service. The remaining three NANR assets, projected to produce 4.8 megawatt-hours in 2023, will further diversify KMI’s renewable portfolio by adding electricity generation to its landfill gas-to-power operations.

“We are excited to continue KMI’s commitment to growing our RNG business through the acquisition of NANR’s facilities and expertise,” said Energy Transition Ventures President Anthony Ashley. “We believe this further positions us as a leader in the RNG marketplace and look forward to expanding our RNG footprint to benefit the customers, businesses and communities we serve.”

“We are proud of the business NANR’s employees have built over the past 43 years,” said NANR President Bob Evans. “With the evolution of energy markets, we are excited to join the KMI family as the world transitions to a cleaner energy future.”

KMI expects the four converted RNG facilities become operational over the next 18 months, with the purchase price and additional development capital expenditures representing less than six times the expected 2024 EBITDA.

A slide from a Kinder Morgan investor relations presentations shows details of the purchase. (Image: Kinder Morgan.)

A slide from a Kinder Morgan investor relations presentations shows details of the purchase. (Image: Kinder Morgan.)

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM