Howden closes purchase of CPI

December 22, 2021

Howden said the acquisition reinforces its role in supporting the ongoing energy transition towards renewable sources of energy.

Howden said the acquisition reinforces its role in supporting the ongoing energy transition towards renewable sources of energy.

Howden has closed its previously announced purchase of Compressor Products International (CPI) for $195 million.

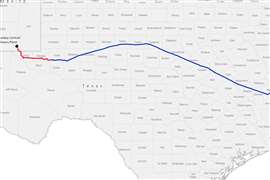

Houston-based CPI manufactures precision-engineered, custom aftermarket products which are vital to the longevity, efficiency and safety of reciprocating compressors. The agreement was previously announced on Oct. 12.

The deal marked Howden’s sixth acquisition of 2021 and is well aligned with Howden’s strategy of expanding its global aftermarket presence in the compressor market. CPI’s strategically located service centers, enable Howden to expand its aftermarket services and coverage across North America and Europe, Howden said.

CPI’s valves and aftermarket products are complementary and strategically important additions to Howden’s existing aftermarket compressor technology portfolio. As a result of this acquisition, Howden’s addressable markets will increase by $1 billion, the company said.

As part of Howden, CPI will be able to access growth opportunities through additional technology support from Howden and by leveraging Howden’s existing global distribution and services network in China, Asia Pacific and South Africa. With CPI’s predominantly aftermarket revenues, this acquisition will be accretive to both Howden’s aftermarket mix and overall margins.

This acquisition also reinforces Howden’s role in supporting the ongoing energy transition towards renewable sources of energy. Howden will leverage CPI’s reciprocating compressor technology to support customers through their energy transition.

“Reciprocating compression technology is critical to the energy transition, with applications in hydrogen production and infrastructure, as well as biofuel production,” said HOwden CEO Ross B Shuster. “CPI’s technology, expertise and aftermarket presence will allow us to serve customers looking to improve the performance and extend the life of their vital compressor assets across a wide range of industries.”

For its part, EnPro said the sale of CPI enables it to transform towards industrial technology businesses serving secular growth markets with unique products and services. CPI was previously included in Enpro’s Engineered Materials segment and comprised the majority of Enpro’s oil & gas end market exposure.

Enpro expects to use after-tax net proceeds of approximately $170 million from the sale of CPI to reduce debt incurred to partially fund the company’s recently completed acquisition of NxEdge, which is expected to reduce Enpro’s net leverage ratio to approximately 3.3x net debt to trailing-twelve-month adjusted EBITDA.

The completion of the sale furthers Enpro’s portfolio reshaping strategy as it continues its transformation towards industrial technology businesses serving secular growth markets with unique products and services. CPI was previously included in Enpro’s Engineered Materials segment and comprised the majority of Enpro’s oil & gas end market exposure.

Enpro expects to use after-tax net proceeds of approximately $170 million from the sale of CPI to reduce debt incurred to partially fund the company’s recently completed acquisition of NxEdge, which is expected to reduce Enpro’s net leverage ratio to approximately 3.3x net debt to trailing-twelve-month adjusted EBITDA.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM