Read this article in 中文 Français Deutsch Italiano Português Español

European hydrogen infrastructure struggles to pick up momentum

July 21, 2025

Plans to build new clean hydrogen infrastructure in Europe have hit multiple setbacks, raising doubts about whether the continent will meet its ambitious targets

A rendering of the H2 Green Steel large-scale green steel plant in northern Sweden. Image: Stegra

A rendering of the H2 Green Steel large-scale green steel plant in northern Sweden. Image: Stegra

Plans to develop clean hydrogen supply chains across Europe face a range of obstacles. Although some progress has been made, it remains insufficient to meet the European Union’s goal of producing 10 million metric tons of renewable hydrogen by 2030 — alongside importing another 10 million tons.

The challenges affect both blue hydrogen — produced from natural gas with carbon capture and storage — and green hydrogen, made by electrolysis powered by renewable energy. These obstacles include technical, financial, market, and regulatory issues.

Pipeline infrastructure to connect hydrogen production with demand hinges on certainty that production projects will proceed. Yet, production projects depend on pipeline infrastructure to be viable, creating a classic chicken-and-egg problem.

To accelerate clean hydrogen development, coordinated action from governments, regulators, industry, and the EU is critical. Without it, hydrogen’s role in Europe’s energy mix risks being far smaller than planned.

One step forward, two steps back

Progress on hydrogen infrastructure has been slow and uneven. Morningstar Sustainalytics stewardship managers Marta Mancheva and Amar Causevic say advances in 2024 have been “much slower” than expected.

“Industry optimism going into 2024 gave way to modest advances and notable delays,” they told COMPRESSORTech2 in writing.

While some final investment decisions (FIDs) have been made and new hydrogen strategies announced, overall momentum is falling short of targets. Mancheva and Causevic noted major players like France’s Engie have pushed back timelines, delaying their 4-gigawatt green hydrogen capacity target from 2030 to 2035.

Ben Clark, senior analyst at Westwood Global Energy Group, said production projects have fared better than pipelines but still lack scale.

“In Q4 2024, only one project took FID with 100 megawatts capacity, while eight projects totaling 4.7 gigawatts were stalled or canceled,” Clark said. “It feels like one step forward, two steps back.”

Several pipeline projects, especially in and around Germany, have seen delays or cancellations. Germany’s planned 9,700-kilometer hydrogen network, estimated at 20 billion euros ($22.6 billion), was delayed five years to 2037. Equinor scrapped plans to export blue hydrogen from Norway to Germany. Denmark postponed a green hydrogen pipeline to Germany by three years, to 2031.

In the UK, BP canceled the 500-megawatt HyGreen Teesside project in March 2025 after stopping 18 early-stage hydrogen projects globally in 2024.

Obstacles holding back hydrogen

Analysts point to several key reasons for delays and cancellations.

Emma Keisser, hydrogen associate at Aurora Energy Research, said a major hurdle is the lack of long-term offtake agreements — contracts that guarantee buyers for hydrogen.

The GET H2 Nukleus project connects the production of green hydrogen with industrial consumers in Lower Saxony and North Rhine-Westphalia. The approximately 130-kilometer network from Lingen to Gelsenkirchen is set to become the first H2 network in the regulated sector with non-discriminatory access and transparent prices. (Illustration: RWE)

The GET H2 Nukleus project connects the production of green hydrogen with industrial consumers in Lower Saxony and North Rhine-Westphalia. The approximately 130-kilometer network from Lingen to Gelsenkirchen is set to become the first H2 network in the regulated sector with non-discriminatory access and transparent prices. (Illustration: RWE)

“Securing 15-year or longer offtake agreements is crucial but difficult,” Keisser said. “Producers need stable demand to justify investments, and electrolyzers face competition for renewable energy, complicating consistent production.”

She also cited a lack of project guarantees for lenders, the challenge of developing many parts of the hydrogen value chain simultaneously, and high market prices relative to gray hydrogen despite subsidies.

“Offtakers want low-cost hydrogen, but current prices remain high, so they hesitate to commit,” Keisser said. “This interdependence among projects, technologies, and customers creates uncertainty, slowing investment decisions.”

Morningstar’s Mancheva and Causevic highlighted high production costs, funding gaps, and limited demand as structural challenges.

“High costs have led to project cancellations like Equinor’s 10-gigawatt Clean Hydrogen to Europe initiative, scrapped due to pipeline and carbon capture costs,” they said. “Even major players struggle without lower costs or more public funding.”

They also said complex EU subsidy schemes may deter investment.

“Navigating the EU’s hydrogen auction rules has caused withdrawals, even from initially subsidized green hydrogen projects,” they said.

Regulatory and permitting complexity also slows progress

“The EU’s strict criteria for renewable fuels of non-biological origin (RFNBO), essentially green hydrogen, are seen as bureaucratic barriers,” Mancheva and Causevic said. The European Court of Auditors criticized the EU hydrogen targets in July 2024 as unrealistic and lacking binding national commitments, especially where permits require multiple layers, such as in Italy.

Demand uncertainty compounds the problem.

“Cancelled projects often lacked offtake commitments because buyers were unwilling to pay a green premium,” Mancheva and Causevic said. “Without long-term buyers like refineries or steelmakers, projects can’t secure financing.”

Clark of Westwood confirmed the same issues.

“High costs, economic challenges, funding failures, and lack of demand are main reasons for project cancellations or stalls,” he said. “Confusing funding and slow infrastructure development make hydrogen cost-competitive only in the long term.”

Clark added that Europe’s focus on production has sometimes left demand behind.

“Without mandates to encourage buyers, projects can’t secure offtake agreements, leading to cancellations,” he said.

The expected role of hydrogen in sectors like road transport and home heating is also shrinking compared with initial hopes.

Morningstar estimates nearly 29 gigawatts of planned clean hydrogen capacity was stalled or canceled in 2024, about one-fifth of the total. Westwood’s 2025 white paper echoes this. In Q1 2025, Westwood reported 13 announced projects totaling 2.5 GW and three projects reaching FID, but also two cancellations totaling 1.1 GW.

Westwood now forecasts that only 17% of the EU’s planned hydrogen projects will be realized without stronger market intervention.

Intervention options

Market interventions could reverse the trend, but they must be rapid, coordinated, and decisive.

Westwood’s white paper identifies three key levers to unlock hydrogen potential: clear policy frameworks, effective funding mechanisms, and strong demand mandates.

Clark says EU rules like RFNBO are unlikely to be revised before 2028 but expects a new delegated act on low-carbon hydrogen with carbon capture to be introduced in 2025.

“Streamlining funding and permitting could speed project development,” Clark said.

Funding is shifting from production to offtake and sector focus, but demand creation still struggles due to multiple overlapping EU mandates.

“We need robust incentives for both supply and demand,” Clark said. “Governments must support producers and consumers through subsidies and consumption mandates.”

Morningstar agrees that streamlined rules and targeted subsidies are critical.

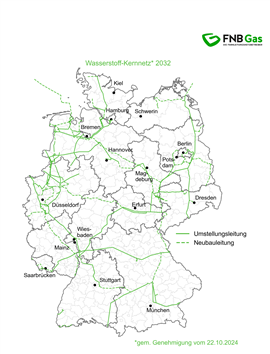

The German Core Network is a major hydrogen transport initiative.

The German Core Network is a major hydrogen transport initiative.

“Faster permitting and harmonized EU regulations can boost confidence,” Mancheva and Causevic said. “Contracts-for-difference and risk-sharing can close cost gaps. Public-private partnerships and innovation funding for electrolysers will help. Co-ordinated infrastructure planning is essential.”

Aurora believes early success in large projects would build investor confidence.

“Shifting financing toward debt is key to unlocking investments,” Keisser said. “But investors need policy clarity and bankable project examples.”

Keisser also sees non-compliance penalties and consumption subsidies as incentives for offtakers.

The consensus is clear: carrots alone may not work; sticks like mandates and penalties may be necessary to boost hydrogen demand.

Bright spots amid challenges

Despite setbacks, some projects show promise.

Germany remains a hydrogen leader. Uniper’s 131-megawatt Green Hydrogen Wilhelmshaven project began pre-front-end engineering design in 2024, secured an electrolyzer provider, and found offtake buyers in the green steel sector.

TotalEnergies signed a long-term deal in March 2025 to buy green hydrogen from RWE’s GET H2 Nukleus project to decarbonize its Leuna refinery.

“Refineries are becoming key green hydrogen buyers in Europe,” Keisser said.

The German Core Network, a major hydrogen transport initiative, is also a key development to watch.

H2 Green Steel (renamed Stegra) in Sweden secured debt financing, equity funding, and an EU grant, showing renewable hydrogen’s potential in steel decarbonization.

Mancheva and Causevic highlighted H2 Green Steel along with other bright spots: the H2Med pipeline linking Spain, France, and Portugal aiming for 2030 operation; and large electrolyzer projects like BP’s Castellón, Shell’s REFHYNE II, and EWE’s Clean Hydrogen Coastline, which reached FIDs in 2024.

“Hydrogen valleys like HySynergy in Denmark are already operational, supplying near-shore industries,” they said.

Aurora said early renewable hydrogen use will focus on decarbonizing industries that already use gray hydrogen. Later, synthetic fuels could drive demand in hard-to-abate sectors like maritime and aviation.

Falling short of targets

The EU is at risk of missing its 2030 hydrogen production and import targets.

“At the end of 2023, Europe used about 7 million tons of hydrogen, 99% fossil-based,” Mancheva and Causevic said.

Clark noted that some countries, including Portugal and Sweden, lack capacity to meet targets.

“Countries like the UK, Spain, and Germany have large project pipelines but also many ‘risked projects’ that may not materialize,” he said.

Clark suggested the EU could boost subsidies in refining, fertilizer, and steel sectors, speed up permitting, increase imports, and provide new offtaker incentives. Mancheva and Causevic expect the EU to respond by scaling up investments, imposing binding mandates in key industries, and focusing on viable hydrogen uses.

Keisser warned incentives alone might not suffice.

“The EU may need stricter penalties for non-compliance on renewable hydrogen consumption,” she said.

She stressed the need for early, successful hydrogen projects to build confidence.

“There is interest and ambition, but investor confidence is lacking,” she said.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM