EIA: LNG pipeline deliveries set record

July 31, 2023

Freeport LNG terminal’s return to service key

With the Freeport LNG terminal’s return to service, natural gas deliveries by pipeline to U.S. liquefied natural gas (LNG) set a record in the first half of 2023, according to the U.S. Energy Information Administration (EIA).

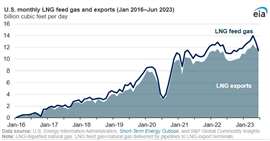

Export facilities averaged 12.8 billion cubic feet per day (Bcf/d) in the first six months of 2023, according to data by S&P Global Commodity Insights. Over this period, LNG feed gas averaged 8%, or 1.0 Bcf/d, more than the 2022 annual average and 4%, or 0.5 Bcf/d, more than the same six-month period in 2022.

LNG feed gas set a monthly record in April 2023 at 14.0 Bcf/d, supported by high international demand for U.S. LNG exports, particularly in Europe. LNG feed gas declined slightly in May and June and averaged 13.0 Bcf/d and 11.5 Bcf/d, respectively, primarily because of maintenance at several U.S. LNG export facilities, including Sabine Pass and Cameron.

LNG feed gas levels are typically higher than LNG export levels because LNG export terminals consume some of the feed gas to operate on-site liquefaction equipment. All U.S. LNG export facilities, except Freeport LNG, use natural gas turbine-driven refrigerant compressors to convert natural gas from a gaseous to a liquid state. Freeport LNG is the only liquefaction facility in the United States that uses electric motors instead of natural gas turbines to drive refrigerant compressors. As a result, most of Freeport LNG’s feed gas is converted into LNG.

“We estimate approximately 14% of LNG feed gas is used for liquefaction processes, mostly to operate on-site liquefaction equipment,” according to the EIA. “In our Short-Term Energy Outlook (STEO), we account for feed gas used in the liquefaction process and natural gas consumed in pipeline transportation in the Natural Gas Pipeline and Distribution Use category in Table 5a.

“We forecast U.S. LNG exports to average 12.0 Bcf/d in 2023 and 13.3 Bcf/d in 2024, as two new LNG liquefaction projects are expected to come online—Golden Pass and Plaquemines. Global economic conditions and demand for natural gas in Europe and Asia may affect our forecast. The assumed ongoing replacement of Russia’s natural gas exports by pipeline to Europe with LNG supports higher U.S. LNG exports going forward. Limited growth in global LNG export capacity in the next two years may increase the need for destination-flexible LNG supplies, mainly from the United States.”

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM