China Pushing Gas Production

September 23, 2019

Over the last several years, consumption of natural has in China has increased significantly. And global gas producers, including the U.S., have scrambled to address the growing demand, primarily through increased shipments of liquefied natural gas (LNG).

Now, however, it seems like the Chinese would like to have a little more of that demand met domestically, as the Chinese government has introduced new incentives for domestic production of tight and shale gas and coalbed methane

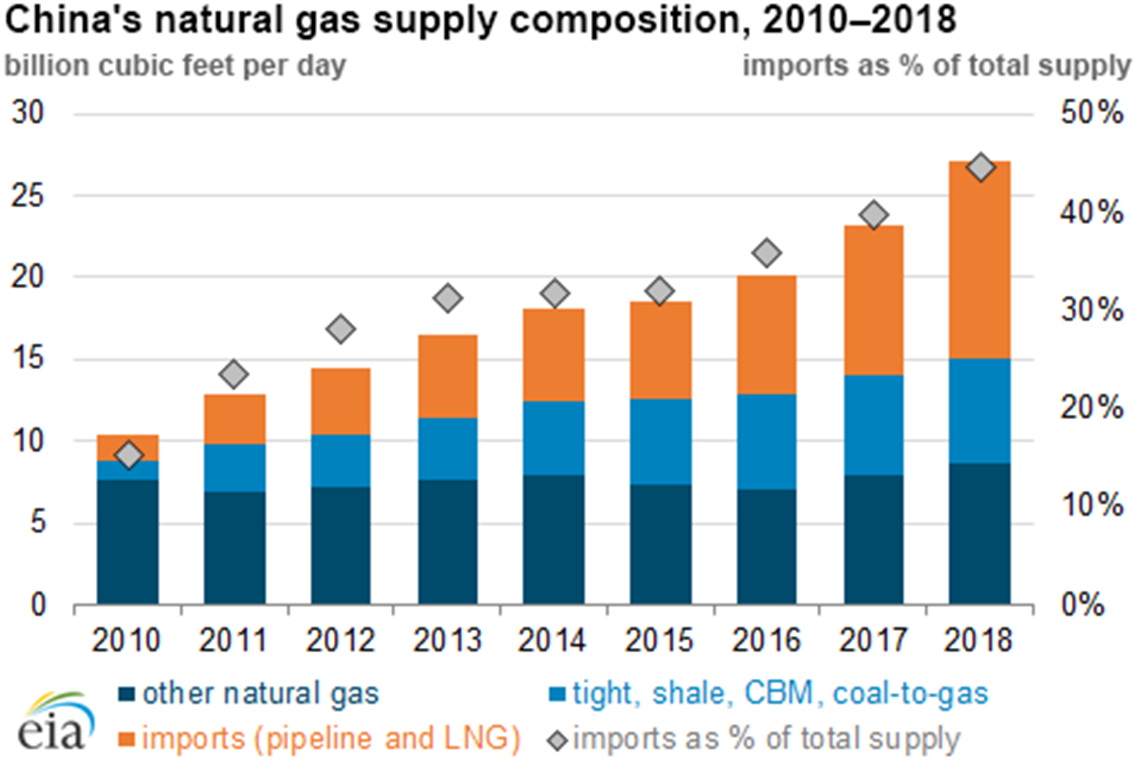

A new subsidy program recently introduced for the first time offers incentives for domestic production of natural gas from tight formations. The program also extends subsidies for natural gas production from shale formations and from coalbed methane (CBM). The new subsidy program aims to stimulate further growth in domestic natural gas production and to reduce China’s increasing reliance on imports, which have grown from 15% of the total supply in 2010 to 45% in 2018.

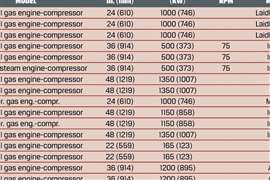

In recent years, rapid growth in China’s natural gas consumption has outpaced the growth in its domestic production, which resulted in increased natural gas imports by both pipeline and LNG, particularly in peak winter months. Between 2010 and 2018, China’s domestic natural gas production increased by 6.1 Bcfd, accounting for 37% of total supply growth, while natural gas imports grew by 10.5 Bcfd (63% of total supply growth) during the same period.

Between 2010 and 2018, natural gas production from tight resources increased by 3.3 Bcfd, while shale production increased by 1.0 Bcfd and CBM production grew by 0.6 Bcfd. In 2018, production from these resources accounted for 43% of total natural gas production in China, which included tight gas (28%), shale (7%), CBM (6%), and coal-to-natural gas (called synthetic gas) (2%).

In the new subsidy program, which goes through 2023, CBM production qualifies for higher subsidies than natural gas produced from shale and tight formations, reflecting the higher cost of CBM production. For production from tight formations, only the incremental volume based on 2017 production levels will qualify for subsidies. Natural gas produced during the heating season (November through February) receives higher subsidies, giving producers more incentives to help alleviate shortages during peak winter demand. The Chinese government also removed the requirement for foreign companies to establish partnerships with domestic Chinese companies to operate in the oil and natural gas upstream sector.

China has been developing tight gas from low-permeability formations since the 1970s. Tight gas production was negligible until 2010, when companies initiated an active drilling program that helped lower the drilling cost per vertical well and improve well productivity. Growth in production from shale and CBM resources has been affected by complex geology, deep reservoirs, low well productivity, and some of the highest per unit production costs of the Chinese natural gas resource base.

In September 2018, the Chinese State Council set a target of 19.4 Bcfd for domestic natural gas production in 2020. To meet this target, China needs to increase total natural gas production by 4.4 Bcfd compared with the 2018 level.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM