Burckhardt 1H22 sales rise 25%

November 01, 2022

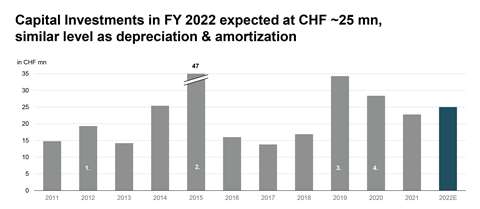

Burckhardt plans about CHF 25 million in capital expenditures in fy 2022. (Graph: Burckhardt investor presentation.)

Burckhardt plans about CHF 25 million in capital expenditures in fy 2022. (Graph: Burckhardt investor presentation.)

Burckhardt Compression saw its order intake, operating profits, and sales jump abruptly in the first half of fy 2022 when compared with the same period a year ago.

Order intake rose nearly 57% to CHF 706.7 million, a record for the company. Sales were CHF 335.8 million, up 25.1% from a year ago. The company’s earnings before interest and taxes (EBIT) reached CHF 35.5 million, up 35% from last year. The company’s second quarter ended Sept. 30.

The company attributed its growth in order intake to a strong post-COVID recovery and several large projects for LNG-marine, solar panels and hydrogen mobility projects.

Looking forward, the company said it expects supply chain challenges to continue but confirms its full-year guidance of Group sales of CHF 720 – 760 million and EBIT margin similar to its fiscal year 2021 margin.

Burckhardt said its new mid-range plan calls for sales to grow annually at 9% and reach about CHF 1.1 billion in 2027. About 40% of that is expected to come form applications which support the world’s energy transition.

It expects EBIT margins in the range of 12% to 15%. The company’s system’s division is expected to see annual growth around 9% to CHF 620 by fiscal year 2027.

“In the last years, we have strengthened our leading market position and remain on course to successfully deliver our mid-range plan 2022 targets,” said Burckhardt CEO Fabrice Billard. “We have enhanced our positioning in traditional markets through an unwavering focus on operational excellence and innovation, supported by targeted acquisitions.”

The company said it is growing quickly in applications towards sustainable and secure energy sources. While the pace of the transformation is not certain, all scenarios from the International Energy Agency (IEA) support growth in Burckhardt’s market. The use of gases is set to increase, Burckhardt said.

Sales at the company’s Systems division were nearly CHF 336 million in H1, up more than 25% from last year. The growth in this division stems from high order volume over the last 18 months, primarily from gas transportation and storage, petrochemical orders, hydrogen mobility and energy, the company said.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM